Blank Employment Verification Document for California

The California Employment Verification form plays a crucial role in the hiring process, ensuring that employers can confirm a candidate's work history and eligibility for employment. This form is typically used to gather information about an applicant's previous jobs, including dates of employment, job titles, and the nature of the work performed. Employers may request this verification to comply with state laws or company policies, and the process helps maintain a transparent hiring environment. Additionally, the form often includes sections for the applicant's consent, allowing the employer to contact previous employers for further information. Understanding how to properly fill out and submit this form can streamline the verification process and enhance the chances of a successful hire. Overall, the California Employment Verification form serves as a vital tool for both employers and job seekers, promoting accountability and trust in the employment landscape.

Similar forms

The I-9 form, officially known as the Employment Eligibility Verification form, is a crucial document used by employers in the United States. Like the California Employment Verification form, the I-9 is designed to confirm an employee's identity and eligibility to work. Both forms require personal information such as name, address, and Social Security number, ensuring that employers comply with federal laws regarding employment eligibility. The I-9 must be completed by all new hires, making it a foundational document in the hiring process.

The W-4 form, or Employee's Withholding Certificate, is another important document that shares similarities with the California Employment Verification form. While the W-4 focuses on tax withholding, it also requires personal information from employees. Both forms are essential for employers to manage payroll accurately. Just as the Employment Verification form helps confirm an employee's status, the W-4 helps determine the correct amount of federal income tax to withhold from each paycheck.

The Form 1099 is used for reporting income for independent contractors, similar to how the California Employment Verification form verifies employment status. While the Employment Verification form is for employees, the 1099 form serves as a record for those who are not classified as employees. Both documents play a vital role in ensuring compliance with tax laws and helping individuals understand their financial obligations.

Understanding the documentation required for vehicle transactions is key for a seamless process. Just as the California Employment Verification form is essential for employment-related matters, the California Motor Vehicle Bill of Sale form plays a critical role in the transfer of vehicle ownership. It is important to ensure that all pertinent information, including buyer and seller details, is accurately recorded. For additional resources on this topic, you can refer to All Templates PDF for templates and guidance that may assist you in completing the required forms correctly.

The Fair Employment Practices Act (FEPA) notice is another document that aligns with the California Employment Verification form. This notice informs employees of their rights against discrimination in the workplace. Just as the Employment Verification form helps establish lawful employment, the FEPA notice ensures that employees are aware of their rights to fair treatment. Both documents are essential for fostering a respectful and compliant work environment.

The California Paid Sick Leave notice is similar in its purpose of informing employees about their rights. While the Employment Verification form confirms employment status, the Paid Sick Leave notice educates employees on their entitlement to sick leave. Both documents aim to empower employees, ensuring they understand their rights and the benefits available to them under California law.

The job offer letter often accompanies the Employment Verification form in the hiring process. This letter outlines the terms of employment, including job title, salary, and start date. Like the Employment Verification form, it serves as a formal acknowledgment of the employment relationship. Both documents are crucial for setting expectations and ensuring that both parties are on the same page from the outset.

The California Wage Theft Prevention Act notice is another document that bears similarities to the Employment Verification form. This notice informs employees about their rights regarding wages and payment practices. Both documents serve to educate employees about their rights and responsibilities, promoting a fair workplace environment. They are essential tools for compliance and employee awareness in California.

The employee handbook is a comprehensive document that outlines company policies and procedures. While it differs in scope from the California Employment Verification form, both documents play a role in establishing the employment relationship. The handbook provides employees with vital information about their rights and responsibilities, similar to how the Employment Verification form confirms their eligibility to work.

Lastly, the California New Hire Reporting form is similar in that it must be completed when a new employee is hired. This form is submitted to the state to assist in child support enforcement and maintain accurate employment records. Like the California Employment Verification form, it serves a regulatory purpose, ensuring that employers comply with state laws while confirming the employment status of new hires.

Document Overview

| Fact Name | Description |

|---|---|

| Purpose | The California Employment Verification form is used to confirm an employee's identity and eligibility to work in the United States. |

| Governing Law | This form is governed by California Labor Code Section 2810.5 and federal laws such as the Immigration Reform and Control Act (IRCA). |

| Required Information | Employers must collect specific information from employees, including their name, address, and Social Security number. |

| Completion Timeline | Employers are required to complete the form within three days of an employee's start date. |

| Retention Period | Employers must retain the completed form for a minimum of three years after the employee's termination. |

| Accessibility | The form must be made available in multiple languages if the employer has a significant number of employees who speak languages other than English. |

Additional State-specific Employment Verification Forms

Work Verification Letter Template - A practical tool for both employees and employers in the verification process.

For those looking to formalize a transaction, an invaluable resource is the downloadable important bill of sale form, which aids in documenting the transfer of personal property ownership securely.

Tennessee Labor Laws - Employers can complete this form to confirm an applicant's work history.

Sample - California Employment Verification Form

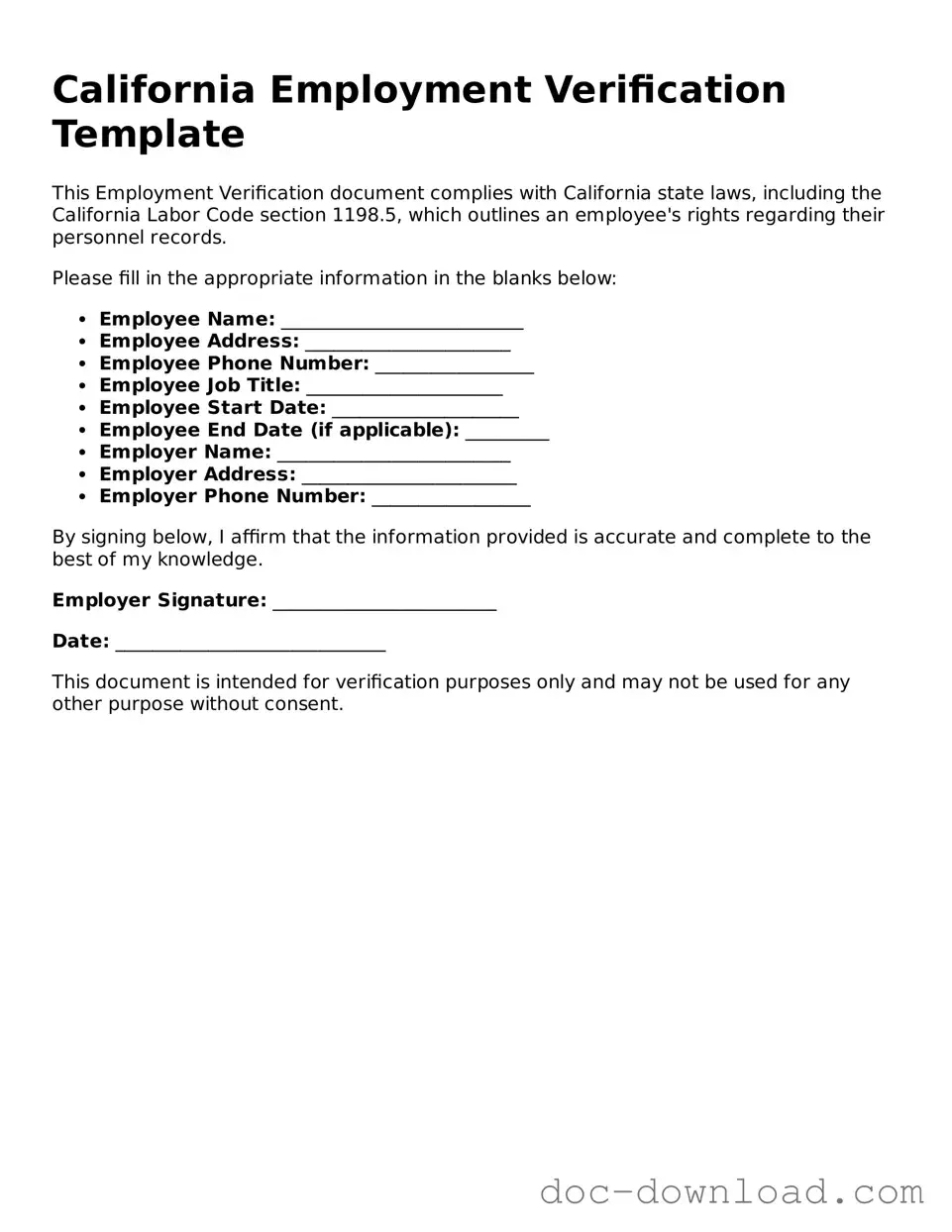

California Employment Verification Template

This Employment Verification document complies with California state laws, including the California Labor Code section 1198.5, which outlines an employee's rights regarding their personnel records.

Please fill in the appropriate information in the blanks below:

- Employee Name: __________________________

- Employee Address: ______________________

- Employee Phone Number: _________________

- Employee Job Title: _____________________

- Employee Start Date: ____________________

- Employee End Date (if applicable): _________

- Employer Name: _________________________

- Employer Address: _______________________

- Employer Phone Number: _________________

By signing below, I affirm that the information provided is accurate and complete to the best of my knowledge.

Employer Signature: ________________________

Date: _____________________________

This document is intended for verification purposes only and may not be used for any other purpose without consent.