Blank Durable Power of Attorney Document for California

The California Durable Power of Attorney form is a crucial legal document that empowers individuals to designate someone they trust to make decisions on their behalf when they are unable to do so. This form is particularly important for managing financial and legal matters, ensuring that your affairs are handled according to your wishes. It remains effective even if you become incapacitated, providing peace of mind for you and your loved ones. The appointed agent can perform a wide range of tasks, from managing bank accounts and paying bills to making investment decisions. Importantly, this form allows you to specify the extent of the authority granted, offering flexibility in how much control you wish to give your agent. Additionally, it can be tailored to suit specific needs, whether for a temporary situation or for long-term management. Understanding the nuances of this form is essential for anyone looking to safeguard their interests and ensure that their voice is heard, even when they cannot speak for themselves.

Similar forms

The California Durable Power of Attorney (DPOA) form is similar to a General Power of Attorney (GPOA). Both documents allow individuals to designate someone else to make decisions on their behalf. However, the key difference lies in the durability of the authority granted. A GPOA typically becomes invalid if the principal becomes incapacitated, while a DPOA remains effective even in such situations. This feature makes the DPOA a more robust option for long-term planning.

Another document that shares similarities with the DPOA is the Healthcare Power of Attorney (HPOA). While the DPOA can cover a wide range of financial and legal matters, the HPOA specifically focuses on medical decisions. By appointing someone to make healthcare choices, individuals ensure that their medical preferences are honored if they cannot communicate them themselves. Both forms empower agents to act on behalf of the principal, but they cater to different aspects of decision-making.

The Living Will is another document that complements the DPOA. This legal instrument outlines an individual's wishes regarding medical treatment in situations where they are unable to express their preferences. While a DPOA can grant authority to an agent to make healthcare decisions, a Living Will explicitly states what those decisions should be in specific scenarios, such as end-of-life care. Together, these documents create a comprehensive approach to healthcare planning.

Similar to the DPOA is the Revocable Living Trust. Both documents are used for estate planning, allowing individuals to manage their assets and provide for loved ones. The DPOA grants authority to an agent to handle financial matters during the principal's lifetime, whereas a Revocable Living Trust allows for the management and distribution of assets after death. While they serve different purposes, both can work in tandem to ensure an individual's wishes are respected.

The Advance Healthcare Directive (AHD) also shares common ground with the DPOA. An AHD combines the elements of a Living Will and a Healthcare Power of Attorney. It allows individuals to express their healthcare preferences and appoint an agent to make medical decisions if they become incapacitated. Like the DPOA, the AHD empowers someone to act on behalf of the individual, ensuring that their healthcare wishes are known and followed.

Understanding the intricacies of real estate transactions in Georgia is essential, and the Georgia PDF Forms play a vital role in facilitating this process by providing necessary documentation, including the critical Statement of Property form.

The Financial Power of Attorney is another document akin to the DPOA. This form specifically focuses on financial matters, granting an agent the authority to manage financial affairs such as banking, investments, and property transactions. While the DPOA can cover both financial and legal matters, the Financial Power of Attorney is tailored for those who want to designate someone to handle only their financial responsibilities.

Finally, the Special Power of Attorney is similar in that it allows individuals to grant authority to someone else. However, the Special Power of Attorney is limited to specific tasks or transactions, unlike the broader scope of the DPOA. For instance, an individual may use a Special Power of Attorney to authorize someone to sell a particular piece of property. This document is useful for targeted actions, while the DPOA provides a more comprehensive authority for ongoing decision-making.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A California Durable Power of Attorney form allows an individual to appoint someone else to manage their financial and legal affairs if they become unable to do so themselves. |

| Governing Laws | This form is governed by the California Probate Code, specifically Sections 4000-4545, which outline the rules and requirements for durable powers of attorney. |

| Durability | The term "durable" indicates that the power of attorney remains effective even if the principal becomes incapacitated, unlike a regular power of attorney which becomes invalid under such circumstances. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent to do so. This ensures that the principal retains control over their affairs. |

Additional State-specific Durable Power of Attorney Forms

Power of Attorney Texas Form - This document does not cover health decisions unless added explicitly for that purpose.

Mo Poa - This document is essential for anyone wanting to plan their future care.

To facilitate a successful vehicle transfer, it is crucial to utilize a reliable Motor Vehicle Bill of Sale documentation. You can access the necessary form here: your complete Motor Vehicle Bill of Sale form template.

Massachusetts Power of Attorney Requirements - This form can be customized to specify exactly what powers you grant to your agent, allowing for flexibility based on your needs.

Sample - California Durable Power of Attorney Form

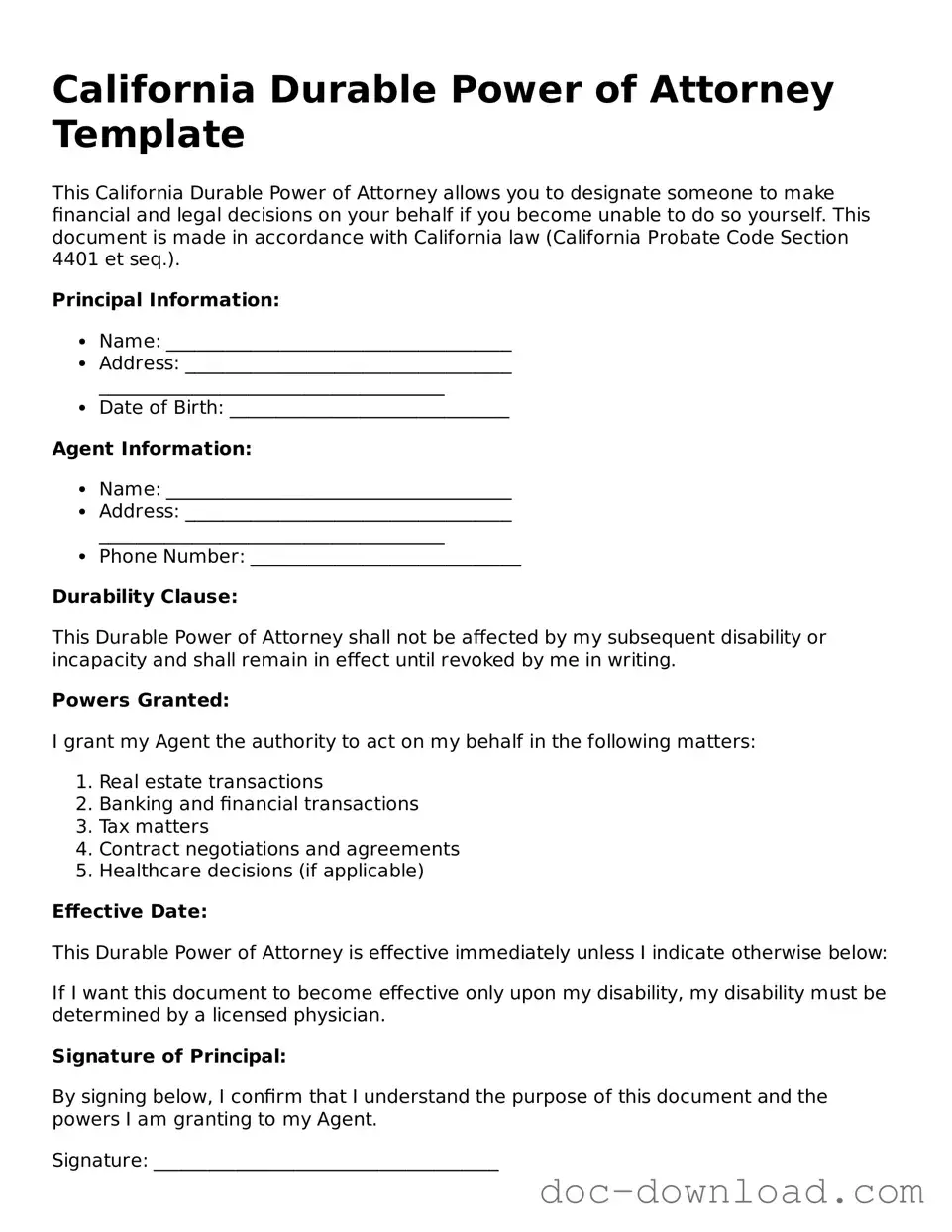

California Durable Power of Attorney Template

This California Durable Power of Attorney allows you to designate someone to make financial and legal decisions on your behalf if you become unable to do so yourself. This document is made in accordance with California law (California Probate Code Section 4401 et seq.).

Principal Information:

- Name: _____________________________________

- Address: ___________________________________

_____________________________________ - Date of Birth: ______________________________

Agent Information:

- Name: _____________________________________

- Address: ___________________________________

_____________________________________ - Phone Number: _____________________________

Durability Clause:

This Durable Power of Attorney shall not be affected by my subsequent disability or incapacity and shall remain in effect until revoked by me in writing.

Powers Granted:

I grant my Agent the authority to act on my behalf in the following matters:

- Real estate transactions

- Banking and financial transactions

- Tax matters

- Contract negotiations and agreements

- Healthcare decisions (if applicable)

Effective Date:

This Durable Power of Attorney is effective immediately unless I indicate otherwise below:

If I want this document to become effective only upon my disability, my disability must be determined by a licensed physician.

Signature of Principal:

By signing below, I confirm that I understand the purpose of this document and the powers I am granting to my Agent.

Signature: _____________________________________

Date: _________________________________________

Witnesses:

Two witnesses who are over the age of 18 must sign below:

- Witness 1: ________________________________

- Witness 2: ________________________________

Date: _________________________________________

Notary Acknowledgment (if applicable):

State of California, County of ______________________

On this ____ day of __________, 20___, before me, ____________________, a Notary Public, personally appeared ________________________, known to me (or proved to me on the basis of satisfactory evidence) to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same.

Signature of Notary: _____________________________