Blank Deed in Lieu of Foreclosure Document for California

When facing the daunting prospect of foreclosure, homeowners in California may find a glimmer of hope in the form of a Deed in Lieu of Foreclosure. This legal document offers an alternative route for those struggling with mortgage payments, allowing them to transfer ownership of their property back to the lender. By doing so, homeowners can avoid the lengthy and often stressful foreclosure process. The Deed in Lieu of Foreclosure can provide a fresh start, helping individuals move on without the burden of an unpaid mortgage hanging over their heads. However, it’s essential to understand the implications of this decision, including the potential impact on credit scores and the necessity of obtaining lender approval. Additionally, homeowners should be aware of any existing liens on the property, as these can complicate the process. Overall, while the Deed in Lieu of Foreclosure may not be the perfect solution for everyone, it represents a viable option for many seeking relief from financial distress.

Similar forms

The California Deed in Lieu of Foreclosure form shares similarities with a Short Sale Agreement. Both documents aim to facilitate a resolution for homeowners facing financial difficulties. In a short sale, the homeowner sells the property for less than the outstanding mortgage balance, with the lender's approval. This process allows the homeowner to avoid foreclosure and minimizes the lender's losses. Like the deed in lieu, a short sale requires cooperation between the homeowner and the lender, focusing on a mutually beneficial outcome.

Another document comparable to the Deed in Lieu of Foreclosure is the Mortgage Modification Agreement. This agreement allows homeowners to modify the terms of their existing mortgage, potentially lowering monthly payments or extending the loan term. By adjusting the loan terms, the homeowner may avoid foreclosure while retaining ownership of the property. Both documents serve as alternatives to foreclosure, providing solutions for financially distressed homeowners while addressing the lender's interests.

The Forbearance Agreement is also similar to the Deed in Lieu of Foreclosure. In this arrangement, the lender agrees to temporarily suspend or reduce mortgage payments for the homeowner facing financial hardship. This document provides a short-term solution, allowing the homeowner time to recover financially. Like the deed in lieu, the forbearance agreement requires communication and cooperation between the homeowner and the lender to reach a satisfactory resolution.

In Colorado, various legal documents play a crucial role in property management and ownership transitions. Among these, the Colorado Hold Harmless Agreement form is essential for ensuring that one party is not held liable for the risks assumed by another party. This critical form can help protect individuals and businesses involved in real estate transactions, construction projects, or any agreements where liability might arise. For further details and templates, you can refer to Colorado PDF Forms.

A Loan Assumption Agreement bears resemblance to the Deed in Lieu of Foreclosure as well. In this situation, a buyer assumes the existing mortgage from the seller, typically with the lender's consent. This process can benefit both parties, as the seller avoids foreclosure, and the buyer may acquire the property with favorable financing terms. Both documents aim to provide a pathway for homeowners to exit a financially burdensome situation while addressing the lender's concerns.

The Release of Liability document is another related form. This document releases the borrower from personal liability for the mortgage debt upon the transfer of property ownership. In cases where a deed in lieu is executed, the lender may agree to release the homeowner from further obligations. Both documents focus on alleviating the financial burden on the homeowner while ensuring that the lender's interests are protected during the transfer of property ownership.

Lastly, the Bankruptcy Filing can be considered similar to the Deed in Lieu of Foreclosure. When a homeowner files for bankruptcy, it provides an automatic stay on foreclosure proceedings, allowing the individual time to reorganize their debts. While the deed in lieu offers a more direct resolution to avoid foreclosure, both processes aim to provide relief for financially distressed homeowners. Each option requires careful consideration of the homeowner's financial situation and the potential impact on their credit and future financial opportunities.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer their property to the lender to avoid foreclosure. |

| Governing Law | California Civil Code Section 1475 governs the Deed in Lieu of Foreclosure process in California. |

| Eligibility | Homeowners who are facing financial difficulties and are unable to make mortgage payments may qualify for this option. |

| Benefits | This process can help homeowners avoid the lengthy foreclosure process and its negative impact on credit scores. |

| Potential Drawbacks | Homeowners may still face tax implications or deficiency judgments depending on the lender's policies. |

| Documentation | Homeowners must complete and submit a Deed in Lieu of Foreclosure form along with any required financial documentation. |

Additional State-specific Deed in Lieu of Foreclosure Forms

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - This approach can facilitate additional options such as rental agreements post-deed transfer.

The Texas Transfer-on-Death Deed not only simplifies the transfer of property but also ensures that your beneficiaries can receive their inheritance swiftly, without the hassles of probate. This form is essential for anyone looking to secure a smooth transition of their estate and avoid complications for heirs. For detailed guidance on how to properly complete the deed, you can visit https://todform.com/blank-texas-transfer-on-death-deed.

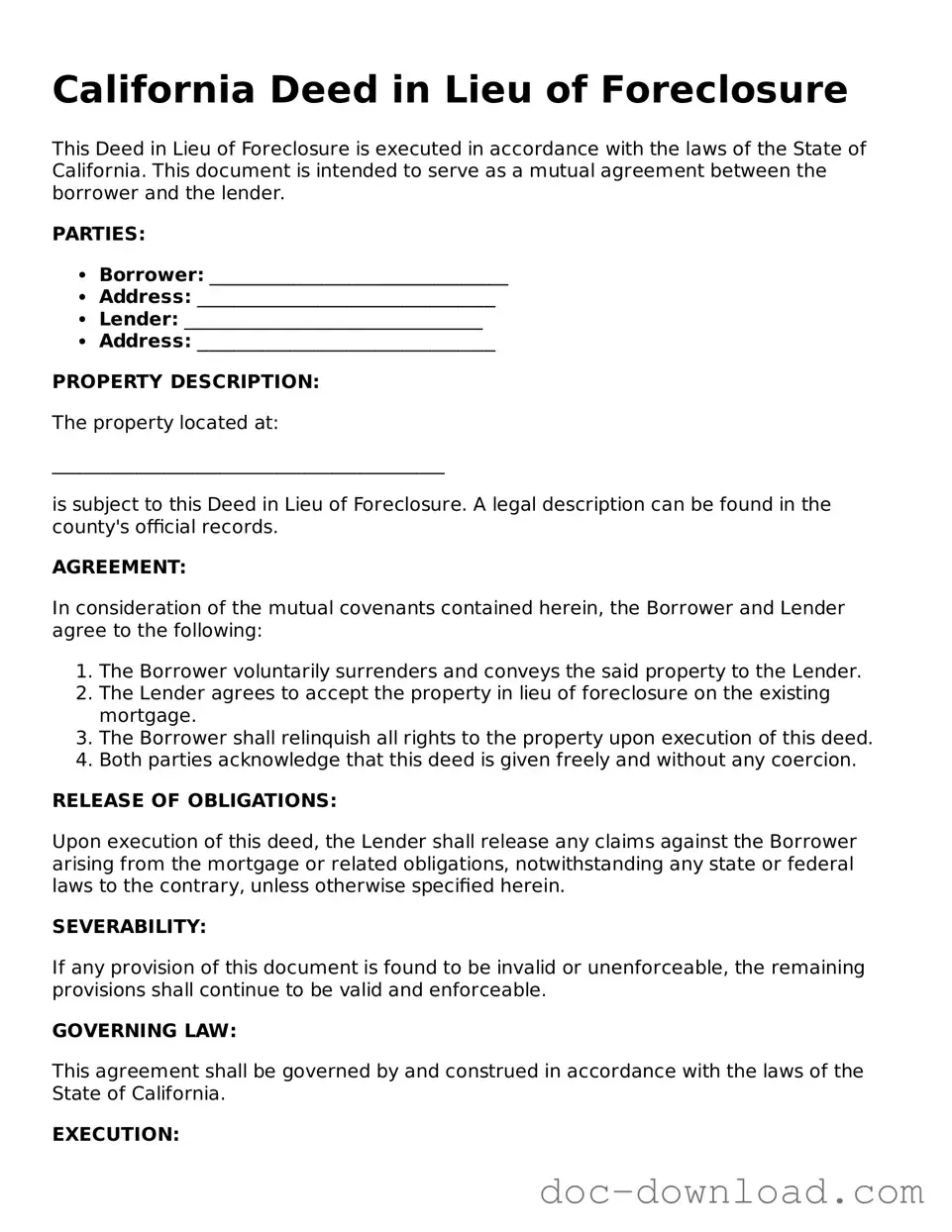

Sample - California Deed in Lieu of Foreclosure Form

California Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is executed in accordance with the laws of the State of California. This document is intended to serve as a mutual agreement between the borrower and the lender.

PARTIES:

- Borrower: ________________________________

- Address: ________________________________

- Lender: ________________________________

- Address: ________________________________

PROPERTY DESCRIPTION:

The property located at:

__________________________________________

is subject to this Deed in Lieu of Foreclosure. A legal description can be found in the county's official records.

AGREEMENT:

In consideration of the mutual covenants contained herein, the Borrower and Lender agree to the following:

- The Borrower voluntarily surrenders and conveys the said property to the Lender.

- The Lender agrees to accept the property in lieu of foreclosure on the existing mortgage.

- The Borrower shall relinquish all rights to the property upon execution of this deed.

- Both parties acknowledge that this deed is given freely and without any coercion.

RELEASE OF OBLIGATIONS:

Upon execution of this deed, the Lender shall release any claims against the Borrower arising from the mortgage or related obligations, notwithstanding any state or federal laws to the contrary, unless otherwise specified herein.

SEVERABILITY:

If any provision of this document is found to be invalid or unenforceable, the remaining provisions shall continue to be valid and enforceable.

GOVERNING LAW:

This agreement shall be governed by and construed in accordance with the laws of the State of California.

EXECUTION:

IN WITNESS WHEREOF, the parties hereto have executed this Deed in Lieu of Foreclosure on this _____ day of __________, 20____.

BORROWER:

__________________________________________

Signature

LENDER:

__________________________________________

Signature

Witnesses:

__________________________________________

Signature

__________________________________________

Signature