Blank Articles of Incorporation Document for California

In the vibrant landscape of California's business environment, the Articles of Incorporation form stands as a crucial document for anyone looking to establish a corporation. This form serves as the foundational blueprint for your business, outlining essential details such as the corporation's name, its purpose, and the address of its principal office. It also requires information about the initial directors and the type of stock the corporation is authorized to issue. Completing this form accurately is vital, as it not only facilitates the legal recognition of your corporation but also ensures compliance with state regulations. Moreover, the Articles of Incorporation can influence your business's tax status and liability protections. Understanding the intricacies of this form is not just a bureaucratic step; it’s a significant move toward building a successful enterprise in California. Timely submission of the Articles can expedite the incorporation process, allowing entrepreneurs to focus on what truly matters: growing their business.

Similar forms

The Articles of Organization is a document used for limited liability companies (LLCs) in California. Like the Articles of Incorporation, it serves as a foundational document that establishes the entity's existence. Both documents require basic information, such as the name of the business, its purpose, and the address of the principal office. While the Articles of Incorporation focuses on corporations, the Articles of Organization is tailored for LLCs, providing a different legal structure that offers flexibility in management and taxation.

The Certificate of Incorporation is similar to the Articles of Incorporation but is often used interchangeably in some states. This document also lays the groundwork for a corporation's legal existence. It includes essential details like the corporation's name, registered agent, and the number of shares authorized to be issued. The main distinction lies in the terminology; while California uses "Articles of Incorporation," other states may refer to it as a Certificate of Incorporation, yet both serve the same fundamental purpose of formally creating a corporation.

When engaging in the sale of personal property, it's essential to have the appropriate legal documentation in place, such as a Bill of Sale form, which proves the transaction between the buyer and seller, ensuring clarity and protection for both parties involved.

The Bylaws of a corporation outline the internal rules and procedures governing the organization. While the Articles of Incorporation establish the corporation's existence, the Bylaws provide the framework for how it operates. They detail the roles of directors and officers, the process for holding meetings, and voting procedures. Both documents are essential, but the Articles are filed with the state, while Bylaws are typically kept internally and can be amended as needed without state approval.

The Statement of Information is a document required in California that provides updated information about a corporation's officers, directors, and registered agent. Similar to the Articles of Incorporation, it is filed with the Secretary of State. However, unlike the Articles, which establish the corporation, the Statement of Information serves as a periodic update, ensuring that the state has current data on the entity. This document is crucial for maintaining transparency and compliance with state regulations.

The Partnership Agreement is a foundational document for partnerships, outlining the terms and conditions under which the partners will operate. While it differs from the Articles of Incorporation in that it does not create a separate legal entity, it shares similarities in purpose. Both documents define the structure and governance of the business, detailing roles, responsibilities, and profit-sharing arrangements. Just as the Articles of Incorporation formalize a corporation, the Partnership Agreement formalizes the relationship between partners, providing clarity and expectations for all involved.

Document Overview

| Fact Name | Description |

|---|---|

| Purpose | The California Articles of Incorporation form is used to create a corporation in California, establishing it as a legal entity separate from its owners. |

| Governing Law | This form is governed by the California Corporations Code, particularly Sections 200-220, which outline the requirements for incorporation. |

| Filing Requirements | To file the Articles of Incorporation, you must provide the corporation's name, address, and purpose, along with the names and addresses of the initial directors. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation. As of 2023, the standard fee is $100, but additional fees may apply based on specific circumstances. |

| Processing Time | The processing time for the Articles of Incorporation can vary. Generally, it takes about 5 to 10 business days, but expedited options are available for an additional fee. |

| Importance of Compliance | Filing the Articles of Incorporation correctly is crucial. Failure to comply with state requirements can result in delays or rejection of the application. |

Additional State-specific Articles of Incorporation Forms

Fl Division of Corporations - Establishing a corporation through this document can ensure continuity.

Mo Secretary of State Business Search - Defines the circumstances under which a corporation can be dissolved.

When preparing for the future, understanding the importance of a well-organized estate plan is crucial. A suitable resource for this purpose is the thorough guide to Last Will and Testament considerations, which outlines the necessary steps to ensure your wishes are respected and your loved ones are taken care of after your passing.

Ma Annual Report - Indicates any immediate tax considerations for the corporation.

Indiana Articles of Incorporation - Useful for establishing corporate banking accounts.

Sample - California Articles of Incorporation Form

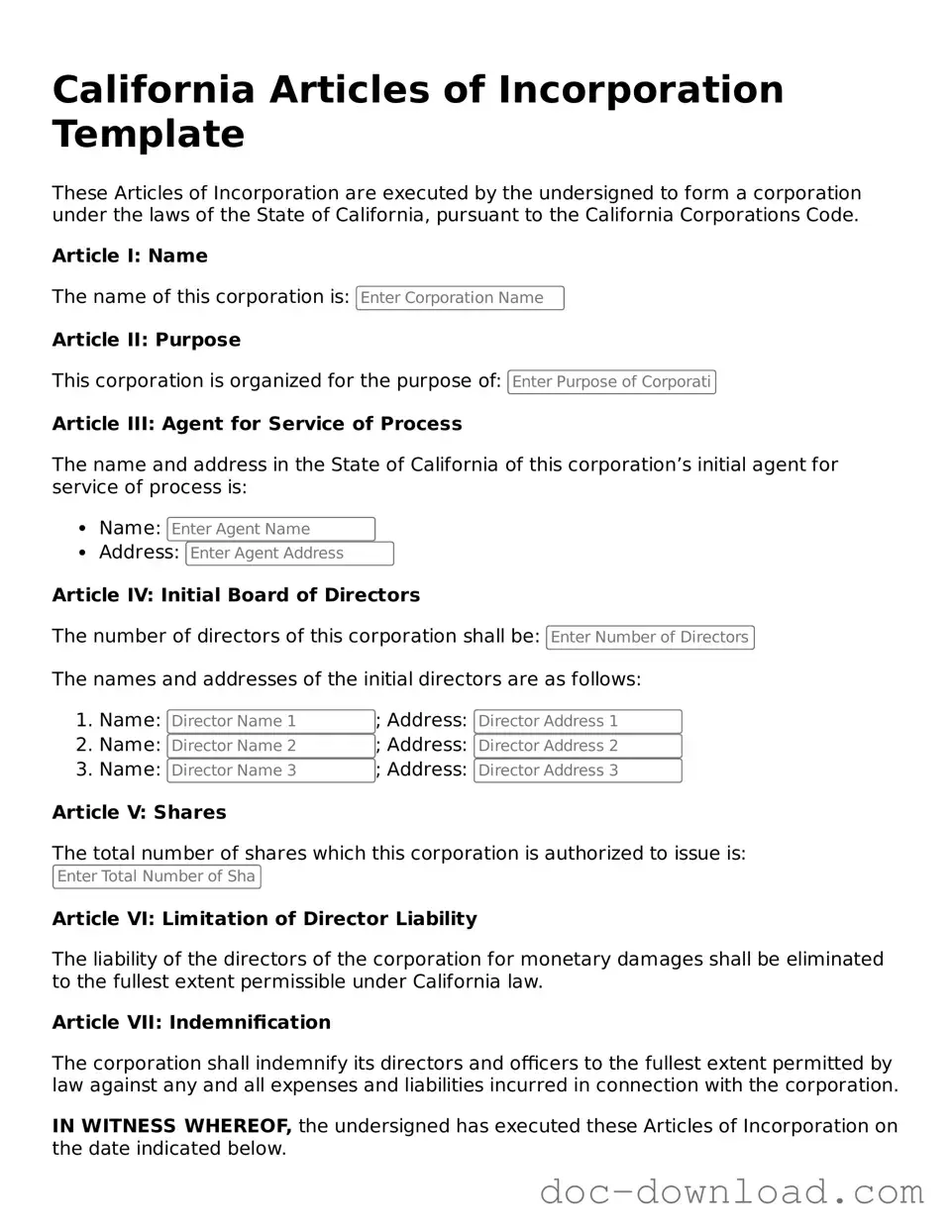

California Articles of Incorporation Template

These Articles of Incorporation are executed by the undersigned to form a corporation under the laws of the State of California, pursuant to the California Corporations Code.

Article I: Name

The name of this corporation is:

Article II: Purpose

This corporation is organized for the purpose of:

Article III: Agent for Service of Process

The name and address in the State of California of this corporation’s initial agent for service of process is:

- Name:

- Address:

Article IV: Initial Board of Directors

The number of directors of this corporation shall be:

The names and addresses of the initial directors are as follows:

- Name: ; Address:

- Name: ; Address:

- Name: ; Address:

Article V: Shares

The total number of shares which this corporation is authorized to issue is:

Article VI: Limitation of Director Liability

The liability of the directors of the corporation for monetary damages shall be eliminated to the fullest extent permissible under California law.

Article VII: Indemnification

The corporation shall indemnify its directors and officers to the fullest extent permitted by law against any and all expenses and liabilities incurred in connection with the corporation.

IN WITNESS WHEREOF, the undersigned has executed these Articles of Incorporation on the date indicated below.

Date:

Signature: