Fill Out Your Business Credit Application Template

When seeking credit for a business, the Business Credit Application form serves as a crucial tool for both lenders and borrowers. This form typically includes essential details such as the business name, address, and contact information. Financial history is another key component, where applicants provide information about their revenue, existing debts, and credit references. Additionally, the form often requests details about the owners or partners, including personal identification and financial backgrounds. This comprehensive approach helps lenders assess the creditworthiness of a business and make informed decisions. Completing the application accurately and thoroughly can significantly impact the approval process and the terms of credit offered. Understanding the importance of each section can empower business owners to present their best case for obtaining the necessary funding.

Similar forms

The Business Loan Application form is quite similar to the Business Credit Application form. Both documents serve as a means for businesses to request financial assistance. They typically require detailed information about the business, including its financial status, ownership structure, and purpose for the funds. The loan application may delve deeper into the specifics of how the funds will be used, while the credit application focuses more on establishing creditworthiness.

The Supplier Credit Application is another document that resembles the Business Credit Application. This form is used by businesses to apply for credit terms from suppliers. Like the credit application, it collects information about the business’s financial history and credit references. The key difference lies in its focus on establishing a credit relationship specifically with suppliers rather than financial institutions.

A Vendor Credit Application is similar in nature to the Supplier Credit Application. It is utilized when businesses seek to establish credit accounts with vendors. Both documents require information about the business's financial health and credit history. The primary distinction is that vendor applications may involve a broader range of suppliers, including those providing goods and services beyond raw materials.

The Commercial Lease Application can also be likened to the Business Credit Application. When a business seeks to lease commercial property, it must provide details about its financial standing and creditworthiness. Both applications aim to assess the ability of the business to meet financial obligations. However, the lease application specifically focuses on real estate and rental terms.

The Business Partnership Agreement shares similarities with the Business Credit Application in that both documents require detailed information about the business and its stakeholders. While the credit application focuses on financial credibility, the partnership agreement outlines the roles, responsibilities, and profit-sharing arrangements between partners. Both documents are essential for establishing trust and clarity in business relationships.

The Business Insurance Application is another related document. When a business seeks insurance coverage, it must provide information about its operations, financial status, and risk factors. Similar to the Business Credit Application, this form assesses the business's viability and risk profile. However, the focus here is on obtaining insurance rather than establishing credit.

The Merchant Account Application is akin to the Business Credit Application as it involves the establishment of a financial relationship. Businesses use this form to request the ability to accept credit and debit card payments. Both applications require financial information and may involve credit checks to determine eligibility, although the merchant account application is specifically tailored for payment processing services.

The Business Grant Application is also comparable, though it serves a different purpose. While the Business Credit Application seeks to establish credit for borrowing, the grant application requests funding that does not need to be repaid. Both forms require detailed business information, financial projections, and the intended use of funds, but the grant application emphasizes community impact and project viability.

To ensure a seamless transfer of ownership for your mobile home, it is essential to complete the required documentation accurately, including the Mobile Home Bill of Sale form, which outlines vital information regarding the buyer and seller, as well as the specifics of the mobile home being sold.

The Credit Reference Request form is similar in that it is often used in conjunction with the Business Credit Application. This document requests information from other creditors or financial institutions regarding the business's credit history. While the credit application collects the business's information, the credit reference request aims to verify that information through external sources.

Finally, the Business Financial Statement is closely related to the Business Credit Application. This document provides a snapshot of the business’s financial health, including assets, liabilities, and income. While the credit application uses this information to assess creditworthiness, the financial statement is a detailed account that may be required as supporting documentation for the credit application itself.

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Business Credit Application form is used by businesses to apply for credit from suppliers or lenders. |

| Information Required | Typically, the form requires details such as the business name, address, ownership structure, and financial information. |

| Creditworthiness | Completing the form helps lenders assess the creditworthiness of the business based on its financial history and current status. |

| State-Specific Forms | Some states may have specific requirements for credit applications, governed by state laws such as the Uniform Commercial Code (UCC). |

| Signature Requirement | A signature from an authorized representative of the business is usually required to validate the application. |

| Review Process | After submission, the application undergoes a review process where the lender evaluates the provided information. |

Different PDF Templates

Minor Travel Consent Letter - The NCL Parental Consent form can be used for a variety of programs, from field trips to sports teams.

Investing in real estate in Georgia requires understanding essential documents, such as the Georgia SOP form, which plays a vital role in ensuring transaction clarity. This form not only outlines the property's condition but also safeguards the interests of both buyers and sellers, fostering transparent negotiations. For more information and resources, including necessary forms, you can visit Georgia PDF Forms.

Lyft Rideshare Inspection Form - Check the oil and fluid levels.

How to File a Claim With Verizon - The form’s design prioritizes clarity and user understanding.

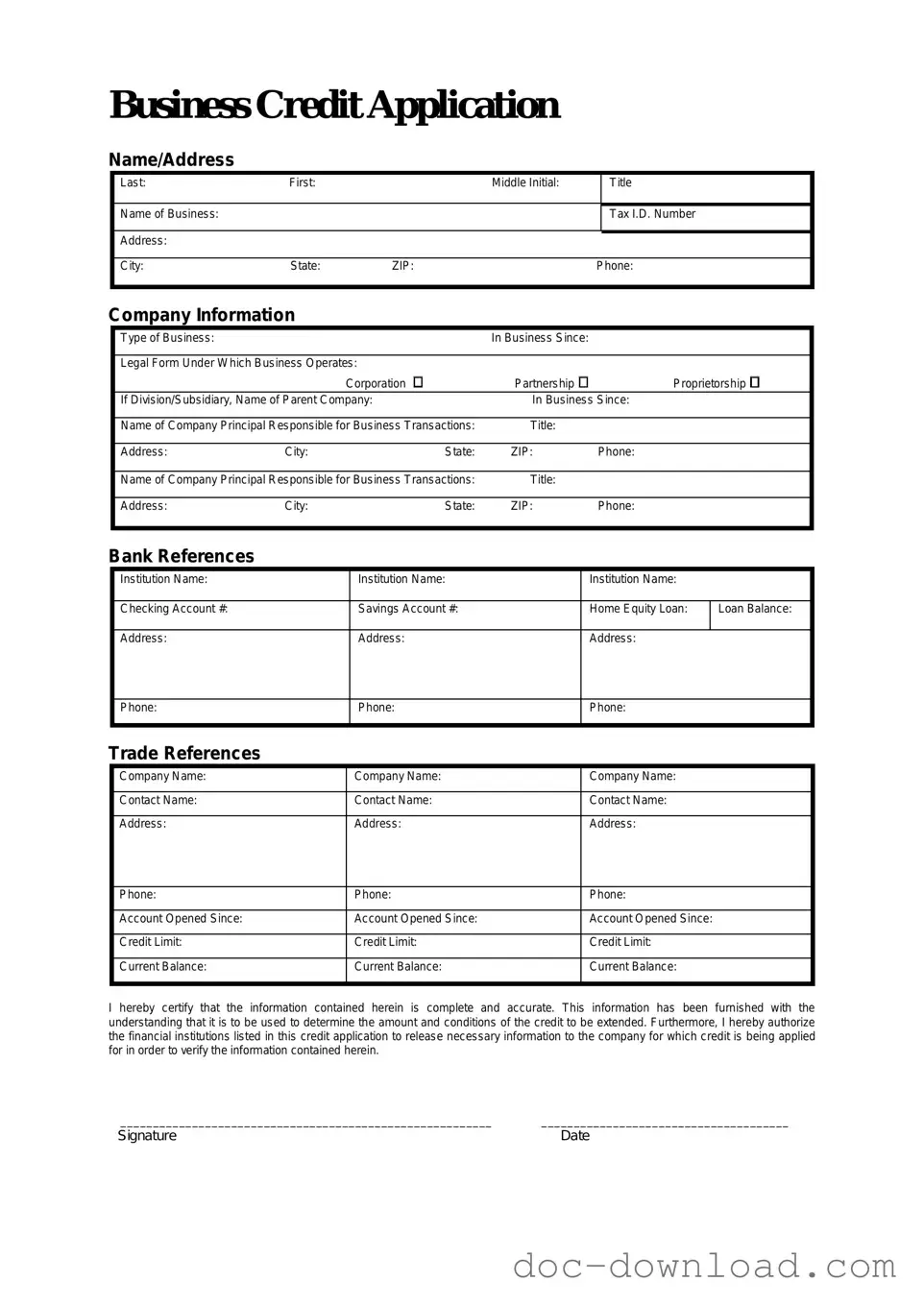

Sample - Business Credit Application Form

Business Credit Application

Name/Address

Last: |

First: |

|

Middle Initial: |

|

Title |

|

|

|

|

|

|

Name of Business: |

|

|

|

|

Tax I.D. Number |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

City: |

State: |

ZIP: |

|

Phone: |

|

|

|

|

|

|

|

Company Information

|

Type of Business: |

|

|

|

In Business Since: |

|

|

|

|

|

|

|

|

|

|

||

|

Legal Form Under Which Business Operates: |

|

|

|

|

|||

|

|

|

Corporation |

Partnership |

Proprietorship |

|

||

|

If Division/Subsidiary, Name of Parent Company: |

In Business Since: |

|

|||||

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

|

|

Bank References |

|

|

|

|

|

|

|

|

|

Institution Name: |

|

|

Institution Name: |

|

Institution Name: |

||

|

|

|

|

|

|

|

|

|

|

Checking Account #: |

|

|

Savings Account #: |

|

Home Equity Loan: |

ILoan Balance: |

|

|

Address: |

|

|

Address: |

|

Address: |

|

|

Phone:

Phone:

Phone:

Trade References

Company Name: |

Company Name: |

Company Name: |

|

|

|

Contact Name: |

Contact Name: |

Contact Name: |

|

|

|

Address: |

Address: |

Address: |

|

|

|

Phone: |

Phone: |

Phone: |

|

|

|

Account Opened Since: |

Account Opened Since: |

Account Opened Since: |

|

|

|

Credit Limit: |

Credit Limit: |

Credit Limit: |

|

|

|

Current Balance: |

Current Balance: |

Current Balance: |

|

|

|

I hereby certify that the information contained herein is complete and accurate. This information has been furnished with the understanding that it is to be used to determine the amount and conditions of the credit to be extended. Furthermore, I hereby authorize the financial institutions listed in this credit application to release necessary information to the company for which credit is being applied for in order to verify the information contained herein.

_________________________________________________________ ______________________________________

Signature |

Date |