Printable Business Bill of Sale Template

The Business Bill of Sale form serves as a crucial document in the transfer of ownership of a business from one party to another. This form outlines essential details, including the names and contact information of both the seller and the buyer, as well as a comprehensive description of the business being sold. It typically includes information about the assets involved, such as equipment, inventory, and any goodwill associated with the business. Additionally, the form may specify the sale price and the terms of payment, ensuring that both parties have a clear understanding of their obligations. By documenting the sale, this form provides legal protection for both the buyer and the seller, minimizing potential disputes in the future. Overall, the Business Bill of Sale is a vital tool that facilitates a smooth transition of ownership while safeguarding the interests of all parties involved.

Similar forms

A Business Purchase Agreement is similar to a Business Bill of Sale in that both documents facilitate the transfer of ownership. While a Business Bill of Sale is a straightforward receipt that confirms the sale, a Business Purchase Agreement outlines the terms and conditions of the sale in greater detail. This includes payment terms, representations and warranties, and any contingencies that must be met before the sale is finalized. Both documents serve as legal proof of the transaction, but the Purchase Agreement provides a more comprehensive framework for the sale.

A Sales Agreement is another document that shares similarities with a Business Bill of Sale. It details the sale of goods or services, specifying what is being sold, the price, and the delivery terms. While a Business Bill of Sale is typically used for the transfer of a business or its assets, a Sales Agreement is more common for individual transactions involving products. Both documents protect the interests of the buyer and seller, ensuring clarity in the transaction.

For those involved in transactions, a comprehensive guide to the General Bill of Sale form can be invaluable. It offers insight into the importance of documenting the transfer of ownership and clarifying the terms of sale. This ensures all parties are informed and protected throughout the process.

An Asset Purchase Agreement is closely related to a Business Bill of Sale. This document is used when a buyer purchases specific assets of a business rather than the entire business itself. It includes details about the assets being sold, such as equipment, inventory, or intellectual property. Like a Business Bill of Sale, it serves as a legal record of the transaction, but it focuses on the assets rather than the business as a whole.

A Lease Agreement can also be compared to a Business Bill of Sale, particularly when a business is being sold along with its leasehold interests. This document outlines the terms under which a tenant can occupy a property. When a business is sold, the lease may be transferred to the new owner, making it essential to document the terms clearly. Both agreements facilitate the transfer of rights and responsibilities associated with the business operation.

A Partnership Agreement has similarities with a Business Bill of Sale when ownership stakes in a business are being transferred. This document outlines the terms of the partnership, including the roles of each partner and how profits and losses are shared. When a partner sells their stake, a Business Bill of Sale may be used to finalize the transaction. Both documents ensure that the transfer of ownership is clear and legally binding.

An Operating Agreement is another document that can be likened to a Business Bill of Sale, especially for LLCs. This agreement details the management structure and operating procedures of the business. When ownership changes hands, the Operating Agreement may need to be updated to reflect the new ownership. Both documents play a crucial role in defining the rights and responsibilities of the parties involved.

A Confidentiality Agreement, or Non-Disclosure Agreement (NDA), shares a connection with a Business Bill of Sale in situations where sensitive business information is involved in the sale. This document ensures that proprietary information remains protected during and after the sale process. While the Business Bill of Sale confirms the transaction, the NDA safeguards the interests of the seller by preventing the buyer from disclosing confidential information.

Finally, a Termination Agreement can be compared to a Business Bill of Sale when a business is being sold as part of winding down operations. This document outlines the terms under which a business ceases to operate, including the sale of assets and settlement of debts. Both documents mark significant transitions in business ownership, ensuring that all parties are clear on the terms of the transaction.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A Business Bill of Sale is a legal document that transfers ownership of a business or its assets from one party to another. |

| Purpose | This document serves to provide proof of the transaction and protect both the buyer and seller by outlining the terms of the sale. |

| Components | Typically includes details such as the names of the buyer and seller, description of the business or assets, purchase price, and date of sale. |

| Governing Law | The laws governing the Business Bill of Sale vary by state. For example, in California, the Uniform Commercial Code applies. |

| Notarization | While notarization is not always required, having the document notarized can add an extra layer of authenticity. |

| Record Keeping | Both parties should keep a copy of the Bill of Sale for their records, as it may be needed for tax purposes or future reference. |

| Asset Types | The form can be used for various types of assets, including equipment, inventory, and intellectual property. |

| Liabilities | It is essential to clarify any liabilities associated with the business, as these may not automatically transfer to the buyer. |

| Legal Advice | Consulting with a legal professional is advisable to ensure that the Bill of Sale meets all legal requirements and adequately protects your interests. |

Other Business Bill of Sale Templates:

Rv Bill of Sale Example - Provides buyers with reassurance regarding their purchase documentation.

How to Get a Title for a Motorcycle Without a Bill of Sale - It typically includes the names and addresses of both the buyer and seller for clarity and record-keeping.

When engaging in transactions, using the appropriate documentation is essential, and one such important document is the Georgia Bill of Sale form. This form not only legitimizes the transfer of ownership but also provides a safeguard for both parties involved. For those looking to obtain a reliable form, you can find it through Georgia PDF Forms, which offers easy access to necessary legal documents.

Do Golf Carts Come With Titles - Can include signatures to validate the transaction.

Sample - Business Bill of Sale Form

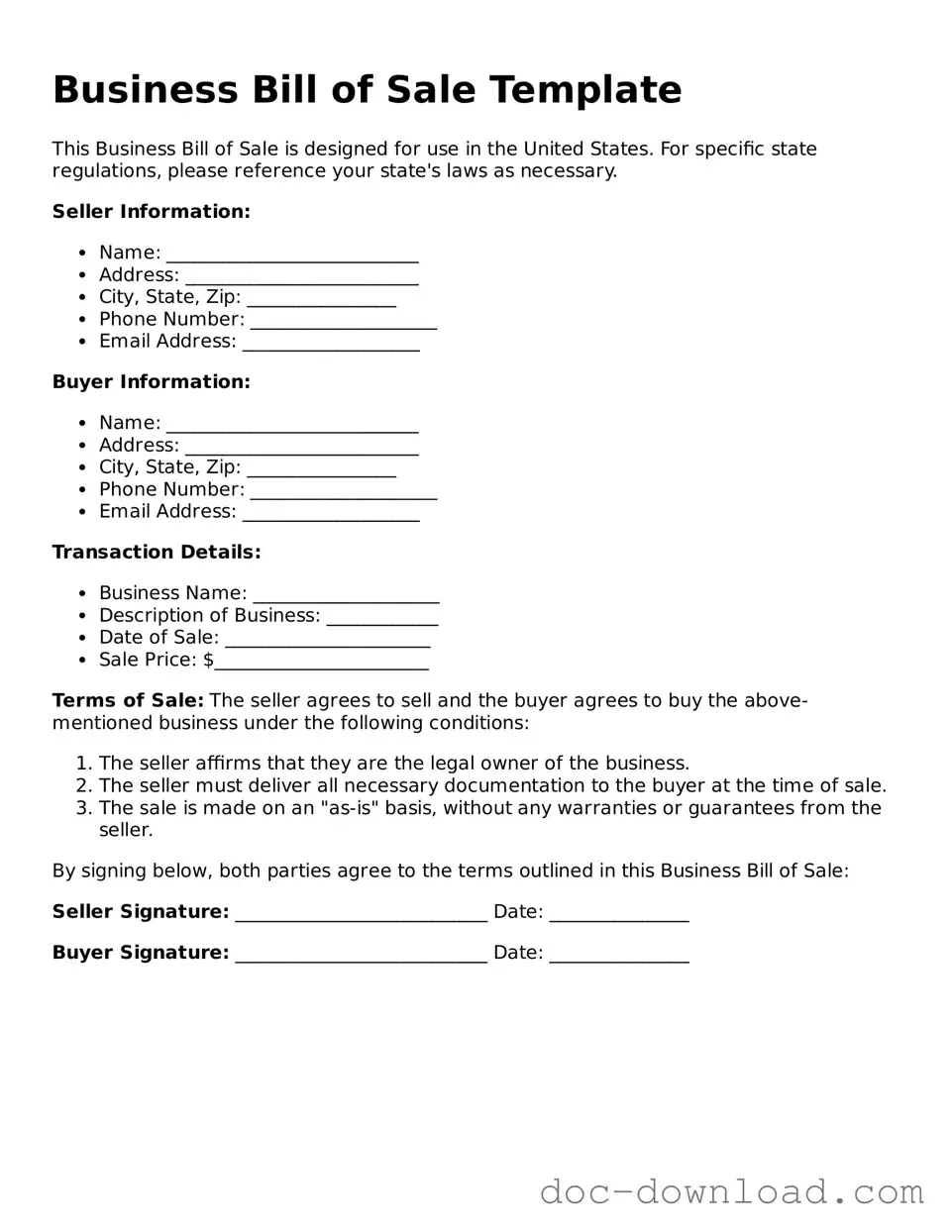

Business Bill of Sale Template

This Business Bill of Sale is designed for use in the United States. For specific state regulations, please reference your state's laws as necessary.

Seller Information:

- Name: ___________________________

- Address: _________________________

- City, State, Zip: ________________

- Phone Number: ____________________

- Email Address: ___________________

Buyer Information:

- Name: ___________________________

- Address: _________________________

- City, State, Zip: ________________

- Phone Number: ____________________

- Email Address: ___________________

Transaction Details:

- Business Name: ____________________

- Description of Business: ____________

- Date of Sale: ______________________

- Sale Price: $_______________________

Terms of Sale: The seller agrees to sell and the buyer agrees to buy the above-mentioned business under the following conditions:

- The seller affirms that they are the legal owner of the business.

- The seller must deliver all necessary documentation to the buyer at the time of sale.

- The sale is made on an "as-is" basis, without any warranties or guarantees from the seller.

By signing below, both parties agree to the terms outlined in this Business Bill of Sale:

Seller Signature: ___________________________ Date: _______________

Buyer Signature: ___________________________ Date: _______________