Fill Out Your Authorization And Direction Pay Template

The Authorization And Direction Pay form plays a crucial role in the claims process for vehicle repairs following an accident. This document streamlines communication between the vehicle owner, insurance company, and repair facility, ensuring that payments are directed appropriately. Key sections of the form include detailed owner and claim information, such as the vehicle's license plate number, insurance company details, and the specific claim number associated with the incident. The form also includes a section where the vehicle owner authorizes the insurance company to pay the repair facility directly, specifying the amount to be paid. This not only facilitates timely repairs but also alleviates potential delays in payment processing. Additionally, the form outlines the owner's responsibility to notify the repair facility if a settlement check is mistakenly sent to them, ensuring that the funds reach the intended party promptly. By providing clear instructions and necessary information, the Authorization And Direction Pay form serves as an essential tool for all parties involved in the claims process.

Similar forms

The Authorization and Direction to Pay form shares similarities with the Power of Attorney document. Both documents grant authority to another party to act on behalf of an individual, but they differ in scope. A Power of Attorney can cover a wide range of decisions, including financial, medical, and legal matters. In contrast, the Authorization and Direction to Pay form is specifically focused on directing payment related to an insurance claim, making it a more limited but equally important tool in financial transactions.

Another document that is akin to the Authorization and Direction to Pay form is the Release of Liability form. When a person signs a Release of Liability, they are essentially agreeing to relinquish any future claims against another party, often in exchange for compensation. This is similar to the direction to pay, as both documents involve an agreement where one party receives payment in return for certain rights or claims. However, the Release of Liability typically pertains to personal injury or property damage claims, while the Direction to Pay is more focused on insurance settlements.

The Assignment of Benefits form is also comparable to the Authorization and Direction to Pay form. This document allows a policyholder to transfer their insurance benefits to a third party, such as a healthcare provider or repair facility. Like the Direction to Pay, the Assignment of Benefits ensures that payment goes directly to the service provider rather than the policyholder. Both forms streamline the payment process and reduce the administrative burden on the insurance company.

The Quitclaim Deed is an essential document in real estate transactions, particularly in Florida, where it allows property owners to transfer their ownership rights quickly and without extensive legal complications. It's often preferred in familial situations or simple ownership changes, ensuring that all parties involved understand the implications of the transfer. To learn more about this process and access the necessary form, visit quitclaimdeedtemplate.com/florida-quitclaim-deed-template/.

Similarly, the Claim Authorization form functions in a way that is reminiscent of the Authorization and Direction to Pay form. This document is used to give permission to an insurance company to process a claim on behalf of the insured. While the Claim Authorization form may not directly involve payment instructions, it is an essential step in the claims process, just as the Direction to Pay is crucial for ensuring that payments are directed to the appropriate party.

The Direct Deposit Authorization form is another document that aligns closely with the Authorization and Direction to Pay form. This form allows individuals to authorize their bank to deposit funds directly into their account. Like the Direction to Pay, the Direct Deposit Authorization simplifies the payment process, ensuring that funds are transferred efficiently and securely. Both documents require clear instructions to avoid any payment mishaps.

In addition, the Insurance Claim Form bears similarities to the Authorization and Direction to Pay form. While the Claim Form is primarily used to report an incident to an insurance company, it often includes sections for directing how payments should be handled. This means that both forms are integral parts of the claims process, working together to ensure that claims are filed accurately and payments are made to the right parties.

The Invoice form is also related to the Authorization and Direction to Pay form. An invoice is a request for payment for services rendered or goods provided. While the Direction to Pay specifically instructs where insurance payments should go, an invoice serves as documentation of the costs incurred. Both documents are vital for financial transactions, ensuring that payments are made promptly and accurately.

The Service Agreement can be compared to the Authorization and Direction to Pay form as well. A Service Agreement outlines the terms and conditions under which services will be provided, including payment details. While the Direction to Pay focuses specifically on directing payment for insurance claims, the Service Agreement establishes the broader framework of the relationship between the service provider and the client, including payment expectations.

Lastly, the Settlement Agreement is akin to the Authorization and Direction to Pay form. A Settlement Agreement is a legally binding document that outlines the terms of a settlement between parties, including payment amounts and timelines. Both documents facilitate the resolution of disputes and the efficient transfer of funds, ensuring that all parties are clear on their rights and obligations.

Form Specifications

| Fact Name | Details |

|---|---|

| Purpose | The Authorization and Direction Pay form allows a vehicle owner to direct their insurance company to pay a repair facility directly for services rendered. |

| Required Information | The form requires the vehicle owner's name, contact information, vehicle details, insurance company name, and claim number. |

| Owner's Obligation | If the insurance company mistakenly sends the payment to the vehicle owner, they must notify the repair facility and deliver the check within 24 hours. |

| Governing Law | The use of this form may be governed by state insurance regulations, such as the California Insurance Code § 790.03, which outlines fair claims practices. |

Different PDF Templates

Girl Friend Application - Let us guide you through the process of finding companionship.

In order to facilitate a smooth transaction when buying or selling a horse, it's important for both parties to complete a Colorado Horse Bill of Sale form. This legal document captures all essential details of the sale, providing necessary evidence of the transaction. For those in need of this form, a reliable source is Colorado PDF Forms, which offers a printable version to ensure compliance and protect both the buyer and seller in the process.

Mortgage Form for Taxes - This document includes your account number and payment due date for clarity.

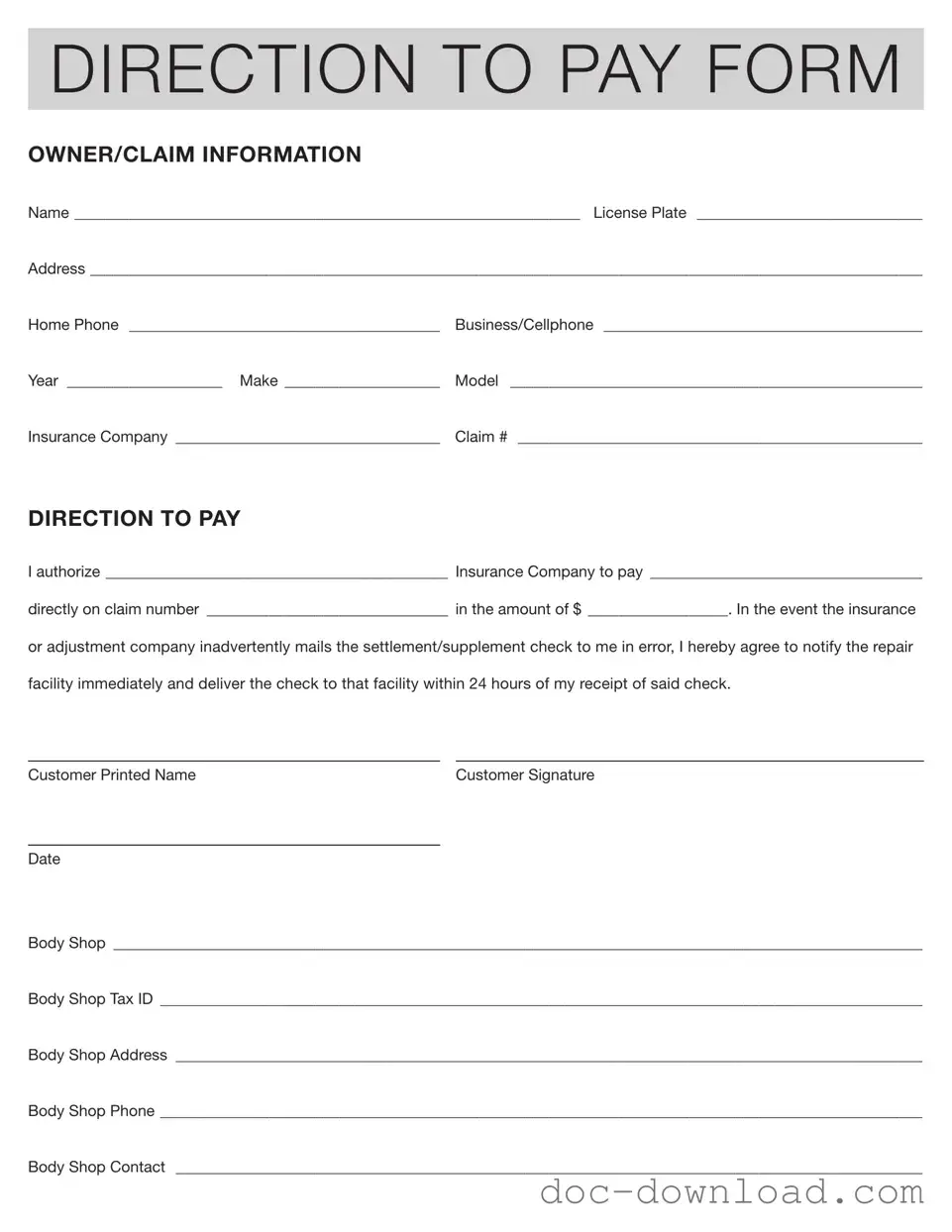

Sample - Authorization And Direction Pay Form

DIRECTION TO PAY FORM

OWNER/CLAIM INFORMATION

Name _________________________________________________________________ License Plate ______________________________

Address ___________________________________________________________________________________________________________

Home Phone _________________________________________ |

Business/Cellphone __________________________________________ |

Year _____________________ Make _____________________ |

Model _ _____________________________________________________ |

Insurance Company ___________________________________ |

Claim # _____________________________________________________ |

DIRECTION TO PAY

I authorize ____________________________________________ Insurance Company to pay ____________________________________

directly on claim number ________________________________ in the amount of $___________________. In the event the insurance

or adjustment company inadvertently mails the settlement/supplement check to me in error, I hereby agree to notify the repair facility immediately and deliver the check to that facility within 24 hours of my receipt of said check.

Customer Printed Name |

Customer Signature |

Date

Body Shop _________________________________________________________________________________________________________

Body Shop Tax ID ___________________________________________________________________________________________________

Body Shop Address _________________________________________________________________________________________________

Body Shop Phone __________________________________________________________________________________________________

Body Shop Contact _________________________________________________________________________________________________