Blank Transfer-on-Death Deed Document for Arizona

In the realm of estate planning, the Arizona Transfer-on-Death Deed (TOD) stands out as a powerful tool for individuals looking to streamline the process of transferring real property upon their passing. This deed allows property owners to designate a beneficiary who will automatically receive the property without the need for probate, simplifying what can often be a complex and lengthy legal process. By utilizing the TOD, individuals can maintain full control over their property during their lifetime, while ensuring that their wishes are honored after they are gone. This form is particularly appealing for those who wish to avoid the costs and delays associated with traditional inheritance methods. Importantly, the TOD can be revoked or altered at any time before the owner's death, providing flexibility in an ever-changing world. As we delve deeper into the specifics of the Arizona Transfer-on-Death Deed, we will explore its benefits, the steps necessary for execution, and the considerations that should be taken into account to ensure that this estate planning tool aligns with one's overall wishes and goals.

Similar forms

The Arizona Transfer-on-Death Deed (TODD) is similar to a will in that both documents allow individuals to dictate how their assets will be distributed after their death. A will, however, must go through probate, a legal process that can be time-consuming and costly. In contrast, a TODD allows property to transfer directly to the designated beneficiary without the need for probate, making it a more efficient option for many people. Both documents require careful consideration and should be crafted with attention to detail to ensure that the individual's wishes are honored.

When dealing with property transactions in Georgia, it's important to utilize the correct legal documentation, such as a Georgia Deed form, to ensure the proper transfer of ownership. You can find the necessary materials for these transactions, including a variety of templates and guidance, at Georgia PDF Forms, making the process smoother for all parties involved.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners to transfer real estate to a beneficiary upon their death without going through probate. |

| Governing Law | The Arizona Transfer-on-Death Deed is governed by Arizona Revised Statutes, Title 33, Chapter 4. |

| Eligibility | Only real property, such as land and buildings, can be transferred using this deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries in the deed. |

| Revocability | The Transfer-on-Death Deed can be revoked at any time by the property owner before their death. |

| No Immediate Transfer | The transfer of property does not occur until the death of the property owner. |

| Recording Requirement | The deed must be recorded with the county recorder's office where the property is located to be valid. |

| Impact on Creditors | The property remains part of the owner's estate and may be subject to creditors' claims until the owner's death. |

| Tax Implications | There are no immediate tax implications for the beneficiary until they sell the property. |

| Form Availability | The Transfer-on-Death Deed form is available through various legal resources and state websites. |

Additional State-specific Transfer-on-Death Deed Forms

Avoiding Probate in California - A Transfer-on-Death Deed does not affect the owner’s rights to use or sell the property during their lifetime.

For individuals seeking to confirm their work history, a reliable option is to obtain a comprehensive Employment Verification document. This form is crucial for various purposes, such as applying for loans or new positions. To access this important paperwork, you can visit us at this link for Employment Verification resources.

Transfer on Death Deed Tennessee Form - A Transfer-on-Death Deed can be cancelled by the owner at any time, as long as they are of sound mind and legal age.

Transfer on Death Deed Missouri Pdf - Creating a Transfer-on-Death Deed is generally straightforward and can be accomplished with minimal legal assistance.

Problems With Transfer on Death Deeds - It is an effective tool for estate planning, ensuring your wishes are fulfilled after death.

Sample - Arizona Transfer-on-Death Deed Form

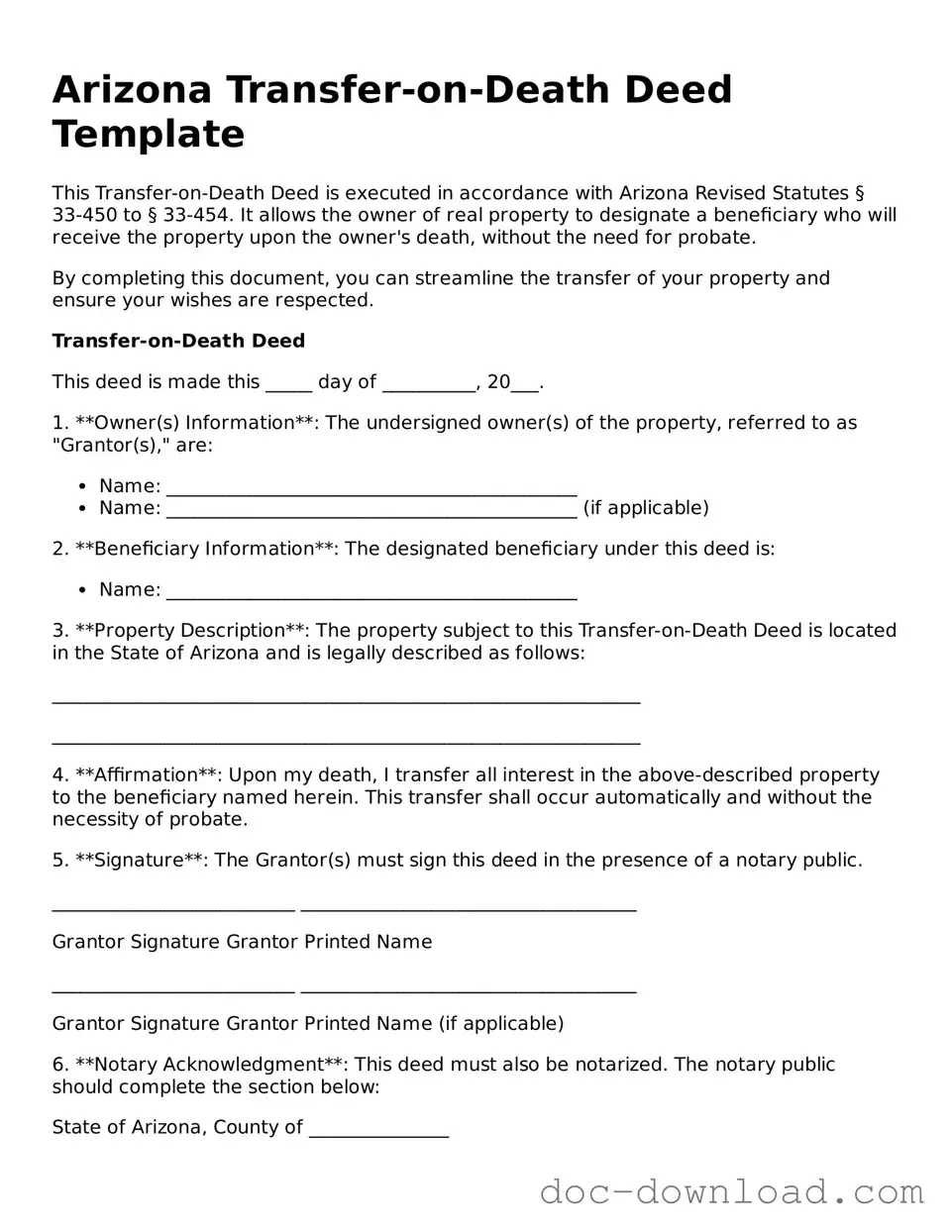

Arizona Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with Arizona Revised Statutes § 33-450 to § 33-454. It allows the owner of real property to designate a beneficiary who will receive the property upon the owner's death, without the need for probate.

By completing this document, you can streamline the transfer of your property and ensure your wishes are respected.

Transfer-on-Death Deed

This deed is made this _____ day of __________, 20___.

1. **Owner(s) Information**: The undersigned owner(s) of the property, referred to as "Grantor(s)," are:

- Name: ____________________________________________

- Name: ____________________________________________ (if applicable)

2. **Beneficiary Information**: The designated beneficiary under this deed is:

- Name: ____________________________________________

3. **Property Description**: The property subject to this Transfer-on-Death Deed is located in the State of Arizona and is legally described as follows:

_______________________________________________________________

_______________________________________________________________

4. **Affirmation**: Upon my death, I transfer all interest in the above-described property to the beneficiary named herein. This transfer shall occur automatically and without the necessity of probate.

5. **Signature**: The Grantor(s) must sign this deed in the presence of a notary public.

__________________________ ____________________________________

Grantor Signature Grantor Printed Name

__________________________ ____________________________________

Grantor Signature Grantor Printed Name (if applicable)

6. **Notary Acknowledgment**: This deed must also be notarized. The notary public should complete the section below:

State of Arizona, County of _______________

Subscribed, sworn to, and acknowledged before me by ____________________________________ (Grantor's name) on this _____ day of __________, 20___.

__________________________

Notary Public Signature

My Commission Expires: _______________

Note: This Transfer-on-Death Deed must be recorded with the County Recorder’s Office in the county where the property is located.

Ensure that all parties understand their rights and responsibilities under this deed. It may be beneficial to consult a legal professional to discuss your specific circumstances before proceeding.