Blank Promissory Note Document for Arizona

In the realm of financial transactions, the Arizona Promissory Note serves as a crucial instrument that outlines the terms under which one party agrees to pay a specific sum of money to another. This document is not merely a piece of paper; it encapsulates the essence of trust and obligation between the lender and borrower. Typically, it includes essential details such as the principal amount, the interest rate, and the repayment schedule, providing clarity and structure to the borrowing process. Additionally, the form often specifies the consequences of default, which can include late fees or legal actions, thereby ensuring that both parties are aware of their rights and responsibilities. Furthermore, the Arizona Promissory Note may also incorporate provisions for prepayment, allowing borrowers the flexibility to pay off their debts ahead of schedule without incurring penalties. By understanding these major aspects, individuals and businesses can navigate the complexities of lending and borrowing more effectively, fostering a sense of security and mutual agreement in their financial dealings.

Similar forms

The Arizona Promissory Note form shares similarities with the Loan Agreement. Both documents outline the terms under which money is borrowed and specify repayment conditions. A Loan Agreement often includes additional details such as collateral, interest rates, and payment schedules. However, while a Loan Agreement can be more comprehensive, a Promissory Note is generally simpler and focuses primarily on the borrower's promise to repay the loan amount.

Another document that resembles the Arizona Promissory Note is the Mortgage. A Mortgage secures a loan with real property as collateral, while a Promissory Note is simply a promise to repay the borrowed amount. Both documents are used in real estate transactions, but the Mortgage provides a legal claim against the property if the borrower defaults, whereas the Promissory Note does not involve any collateral.

The Secured Note is also similar to the Arizona Promissory Note. Like a Promissory Note, a Secured Note includes a borrower's promise to repay a loan. The key difference lies in the security interest. A Secured Note is backed by collateral, providing the lender with a claim to specific assets if the borrower fails to repay. This added layer of security distinguishes it from a standard Promissory Note.

The Unsecured Note is another document that parallels the Arizona Promissory Note. An Unsecured Note does not involve collateral, making it riskier for lenders. Both documents represent a borrower's commitment to repay a loan, but the absence of collateral in an Unsecured Note means that lenders rely solely on the borrower's creditworthiness. This can affect the interest rates and terms offered.

The Demand Note is similar to the Arizona Promissory Note in that it represents a borrower's promise to repay a loan. However, a Demand Note allows the lender to request repayment at any time, unlike a standard Promissory Note, which typically specifies a repayment schedule. This flexibility can be advantageous for lenders but may create uncertainty for borrowers.

When it comes to real estate transactions in Florida, it's essential to understand the different documents involved, one of which is the Quitclaim Deed. This legal form simplifies the process of transferring ownership without title guarantees, making it particularly useful in familial situations or when resolving title disputes. For more detailed information and to access the necessary forms, you can visit https://quitclaimdeedtemplate.com/florida-quitclaim-deed-template.

The Installment Note also resembles the Arizona Promissory Note. Both documents outline the borrower's obligation to repay a loan. The key difference lies in the repayment structure. An Installment Note requires the borrower to make regular payments over time, including both principal and interest, while a Promissory Note may not specify a payment schedule, depending on its terms.

Lastly, the Conditional Note is akin to the Arizona Promissory Note but includes specific conditions that must be met for repayment to occur. While a Promissory Note generally states the obligation to repay without additional conditions, a Conditional Note may stipulate that repayment is contingent upon certain events or actions. This adds complexity to the borrowing agreement.

Document Overview

| Fact Name | Details |

|---|---|

| Definition | An Arizona Promissory Note is a written promise to pay a specified amount of money to a designated person or entity. |

| Governing Law | The Arizona Promissory Note is governed by Arizona Revised Statutes, Title 47, which covers commercial transactions. |

| Parties Involved | The note typically involves two parties: the borrower (maker) and the lender (payee). |

| Interest Rate | The interest rate can be fixed or variable, as agreed upon by both parties in the note. |

| Maturity Date | The maturity date is the date by which the borrower must repay the loan in full. |

| Payment Terms | Payment terms outline how and when payments will be made, including any grace periods. |

| Default Clauses | Default clauses specify the consequences if the borrower fails to make payments as agreed. |

| Amendments | Any amendments to the note must be made in writing and signed by both parties. |

| Notarization | While notarization is not required, having the note notarized can provide additional legal protection. |

Additional State-specific Promissory Note Forms

Can I Get My Mortgage Note Online - The note specifies who owes money, how much is owed, and when it is due.

Promissory Note Template California Word - Promissory notes can serve as a financial tool for both individuals and businesses seeking funding.

Texas Promissory Note Form - Customizable clauses can address unique circumstances or repayment plans.

When completing a transaction involving a horse, utilizing a Colorado Horse Bill of Sale is crucial for protecting both the buyer and seller. This important document not only provides a clear record of the sale but also outlines the specific terms agreed upon by both parties. To simplify this process, you can access valuable resources such as the Colorado PDF Forms, which offer templates and guidance for creating an effective bill of sale.

Tennessee Promissory Note - This document outlines the terms of a loan, including the principal amount and interest rate.

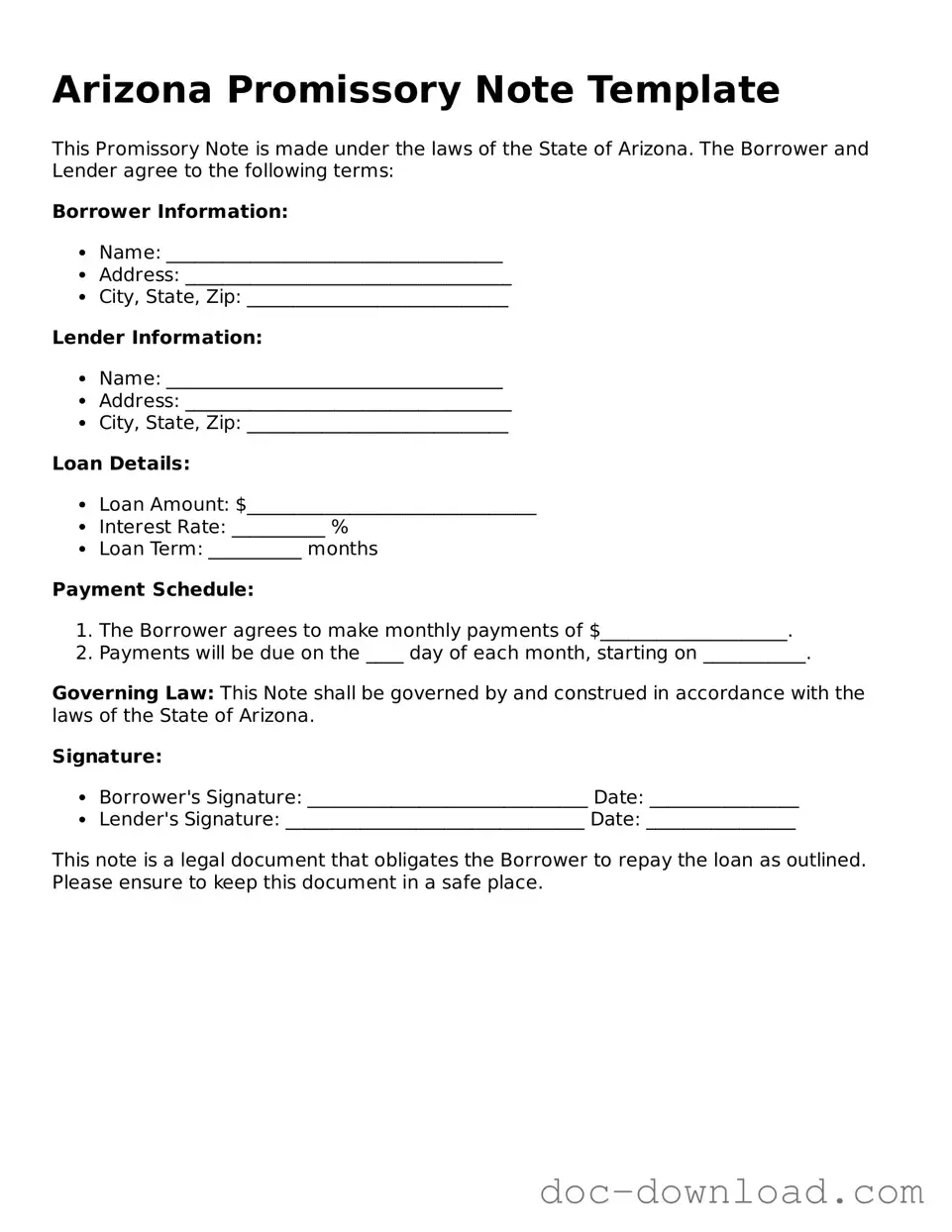

Sample - Arizona Promissory Note Form

Arizona Promissory Note Template

This Promissory Note is made under the laws of the State of Arizona. The Borrower and Lender agree to the following terms:

Borrower Information:

- Name: ____________________________________

- Address: ___________________________________

- City, State, Zip: ____________________________

Lender Information:

- Name: ____________________________________

- Address: ___________________________________

- City, State, Zip: ____________________________

Loan Details:

- Loan Amount: $_______________________________

- Interest Rate: __________ %

- Loan Term: __________ months

Payment Schedule:

- The Borrower agrees to make monthly payments of $____________________.

- Payments will be due on the ____ day of each month, starting on ___________.

Governing Law: This Note shall be governed by and construed in accordance with the laws of the State of Arizona.

Signature:

- Borrower's Signature: ______________________________ Date: ________________

- Lender's Signature: ________________________________ Date: ________________

This note is a legal document that obligates the Borrower to repay the loan as outlined. Please ensure to keep this document in a safe place.