Blank Prenuptial Agreement Document for Arizona

Prenuptial agreements, often referred to as prenups, play a significant role in the planning of marriages in Arizona. These legal documents serve to outline the financial rights and responsibilities of each spouse in the event of a divorce or separation. The Arizona Prenuptial Agreement form typically includes provisions regarding the division of property, spousal support, and the handling of debts acquired during the marriage. It is essential for both parties to fully disclose their assets and liabilities to ensure the agreement is fair and enforceable. Additionally, the form must be signed voluntarily by both individuals, without any coercion, to uphold its validity. Couples often utilize this agreement to protect individual assets and clarify expectations, thereby minimizing potential conflicts in the future. Understanding the components and requirements of the Arizona Prenuptial Agreement form can help individuals make informed decisions as they enter into marriage.

Similar forms

A Cohabitation Agreement is similar to a prenuptial agreement, but it is designed for couples who choose to live together without getting married. This document outlines the rights and responsibilities of each partner regarding shared property, finances, and other aspects of their relationship. Like a prenuptial agreement, a cohabitation agreement can help prevent disputes by clarifying expectations and providing a framework for resolving issues should the relationship end.

A Postnuptial Agreement is another document that resembles a prenuptial agreement. However, it is created after the couple is already married. This agreement allows spouses to outline how they will manage their assets and debts during the marriage and what will happen in the event of a divorce. Both agreements serve a similar purpose: protecting individual interests and providing clarity regarding financial matters.

A Separation Agreement shares similarities with a prenuptial agreement in that it addresses financial and property issues, but it is specifically used when a couple decides to separate. This document outlines how assets and debts will be divided, as well as arrangements for child custody and support if applicable. Like prenuptial agreements, separation agreements can help minimize conflict and provide a clear plan for both parties.

An Estate Plan is another document that can be compared to a prenuptial agreement. While a prenuptial agreement focuses on asset division in the event of a divorce, an estate plan outlines how a person's assets will be distributed after their death. Both documents require careful consideration of assets and can help prevent disputes among family members or heirs by clearly stating intentions.

A Will is similar to a prenuptial agreement in that it addresses the distribution of assets, but it specifically pertains to what happens after a person passes away. Like a prenuptial agreement, a will can help ensure that an individual’s wishes are honored and can reduce potential conflicts among family members regarding inheritance. Both documents are essential for effective planning and protection of individual interests.

A Trust Agreement can also be compared to a prenuptial agreement, as both documents are designed to manage and protect assets. A trust allows a person to place their assets in a legal entity that can be managed by a trustee for the benefit of designated beneficiaries. This can help avoid probate and ensure that assets are distributed according to the individual’s wishes, similar to the goals of a prenuptial agreement.

An Asset Protection Agreement is another document that shares similarities with a prenuptial agreement. This type of agreement is specifically designed to safeguard an individual’s assets from potential creditors or legal claims. Both documents focus on protecting personal wealth and can provide a layer of security for individuals concerned about financial stability in the future.

For those looking to transfer ownership of a mobile home in New York, it’s crucial to have a properly documented Mobile Home Bill of Sale form that outlines the details of the transaction. This legal document lays out the terms between the seller and buyer, providing necessary proof of purchase and facilitating title transfer. To ensure compliance with state regulations and protect both parties' interests, you can download it now.

A Business Partnership Agreement can also be likened to a prenuptial agreement, especially for couples who own a business together. This document outlines the roles, responsibilities, and profit-sharing arrangements between partners. Just as a prenuptial agreement addresses financial matters within a marriage, a business partnership agreement clarifies expectations and helps prevent disputes in a business relationship.

Finally, a Debt Agreement is similar to a prenuptial agreement in that it addresses financial obligations. This document specifies how debts will be managed and divided between partners, particularly in the event of a separation or divorce. Like a prenuptial agreement, a debt agreement can help clarify financial responsibilities and minimize misunderstandings between partners.

Document Overview

| Fact Name | Details |

|---|---|

| Definition | An Arizona prenuptial agreement is a legal document created by two individuals before marriage to outline the distribution of assets and responsibilities in the event of divorce or separation. |

| Governing Law | The governing law for prenuptial agreements in Arizona is primarily found in Arizona Revised Statutes (A.R.S.) § 25-201 to § 25-215. |

| Enforceability | For a prenuptial agreement to be enforceable, it must be in writing and signed by both parties. Oral agreements are not valid. |

| Full Disclosure | Both parties are required to provide a full and fair disclosure of their financial situations, including assets and debts, before signing the agreement. |

| Independent Counsel | It is highly recommended that both parties seek independent legal counsel to ensure they understand their rights and the implications of the agreement. |

| Modification | Prenuptial agreements can be modified or revoked after marriage, but this must also be done in writing and signed by both parties. |

| Judicial Review | A court may review a prenuptial agreement to ensure it is fair and not unconscionable at the time of enforcement. |

| Common Misconceptions | Many believe prenuptial agreements are only for the wealthy. In reality, they can benefit anyone looking to protect their assets and clarify financial responsibilities. |

Additional State-specific Prenuptial Agreement Forms

Florida Prenuptial Contract - A prenup may identify what happens to joint assets upon separation.

Missouri Prenuptial Contract - A Prenuptial Agreement encourages open communication about finances before marriage.

Texas Prenuptial Contract - This document outlines how assets will be divided in case of divorce.

For more detailed guidance on completing the necessary paperwork, including the California LLC 12 Form, you can visit californiapdffoms.com, which provides helpful resources and templates to streamline the filing process.

Massachusetts Prenuptial Contract - A prenup can define each partner's rights and responsibilities related to pets acquired during the marriage.

Sample - Arizona Prenuptial Agreement Form

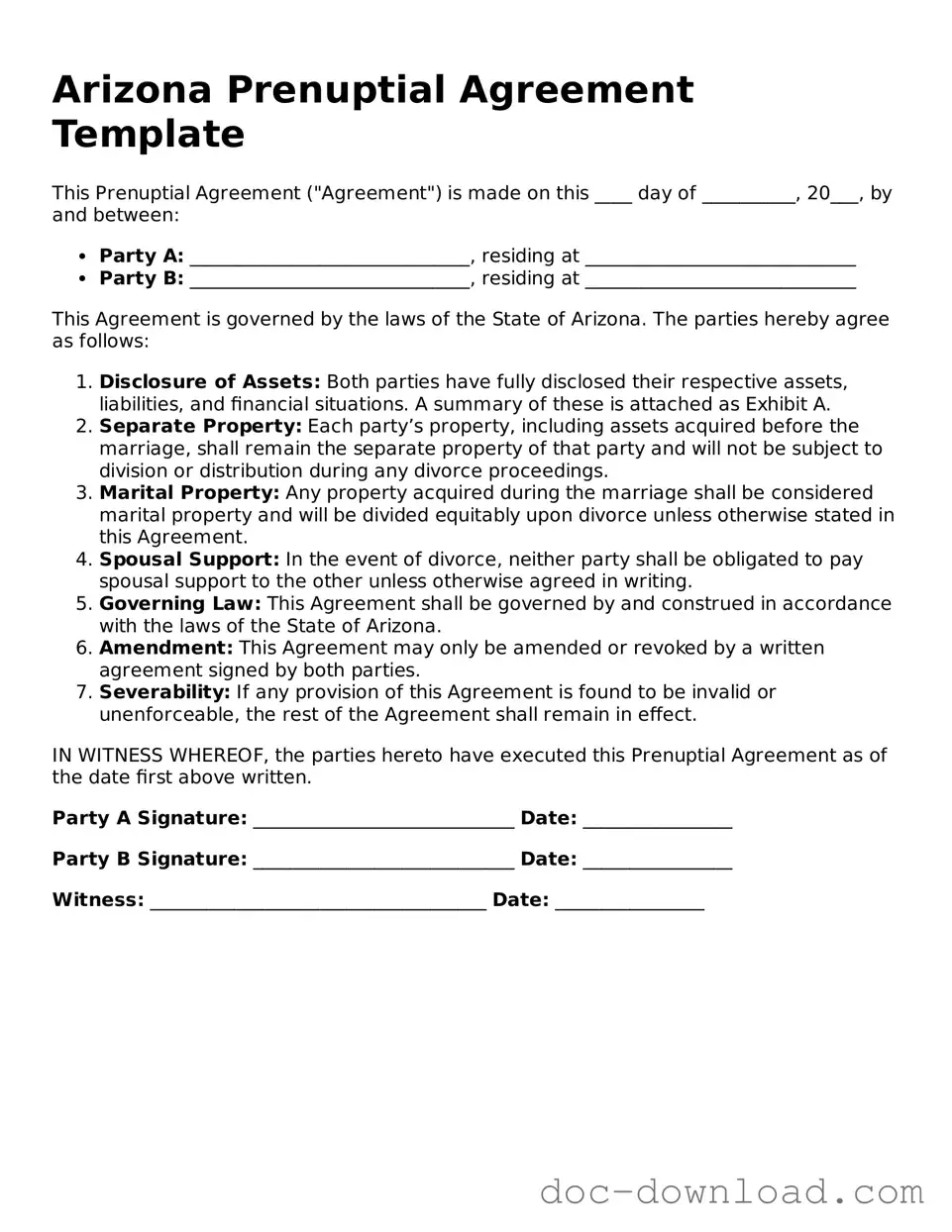

Arizona Prenuptial Agreement Template

This Prenuptial Agreement ("Agreement") is made on this ____ day of __________, 20___, by and between:

- Party A: ______________________________, residing at _____________________________

- Party B: ______________________________, residing at _____________________________

This Agreement is governed by the laws of the State of Arizona. The parties hereby agree as follows:

- Disclosure of Assets: Both parties have fully disclosed their respective assets, liabilities, and financial situations. A summary of these is attached as Exhibit A.

- Separate Property: Each party’s property, including assets acquired before the marriage, shall remain the separate property of that party and will not be subject to division or distribution during any divorce proceedings.

- Marital Property: Any property acquired during the marriage shall be considered marital property and will be divided equitably upon divorce unless otherwise stated in this Agreement.

- Spousal Support: In the event of divorce, neither party shall be obligated to pay spousal support to the other unless otherwise agreed in writing.

- Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of Arizona.

- Amendment: This Agreement may only be amended or revoked by a written agreement signed by both parties.

- Severability: If any provision of this Agreement is found to be invalid or unenforceable, the rest of the Agreement shall remain in effect.

IN WITNESS WHEREOF, the parties hereto have executed this Prenuptial Agreement as of the date first above written.

Party A Signature: ____________________________ Date: ________________

Party B Signature: ____________________________ Date: ________________

Witness: ____________________________________ Date: ________________