Blank Durable Power of Attorney Document for Arizona

The Arizona Durable Power of Attorney form is a crucial legal document that empowers individuals to designate a trusted person to make decisions on their behalf when they are unable to do so. This form is designed to remain effective even if the principal becomes incapacitated, ensuring that their financial and medical affairs can be managed without interruption. Key aspects of the form include the ability to specify the scope of authority granted to the agent, which can range from handling financial transactions to making healthcare decisions. It also allows for the selection of alternate agents in case the primary agent is unable or unwilling to act. Completing the form requires careful consideration of the principal's wishes and the selection of a reliable agent who will act in their best interest. Additionally, the form must be signed and dated in the presence of a notary public to ensure its validity. Understanding these components is essential for anyone looking to establish a Durable Power of Attorney in Arizona, as it provides peace of mind and clarity in times of uncertainty.

Similar forms

The Arizona Durable Power of Attorney (DPOA) form is similar to the General Power of Attorney (GPOA). Both documents allow an individual, known as the principal, to designate another person, referred to as the agent, to make decisions on their behalf. However, the DPOA remains effective even if the principal becomes incapacitated, while the GPOA typically becomes void in such circumstances. This distinction is crucial for individuals seeking to ensure their financial and legal matters are managed during periods of incapacity.

Another similar document is the Healthcare Power of Attorney (HCPOA). This form specifically grants an agent the authority to make medical decisions for the principal if they are unable to do so themselves. While both the DPOA and HCPOA allow for the delegation of authority, the HCPOA focuses exclusively on health-related matters, making it essential for individuals who want to ensure their healthcare preferences are respected in times of medical crisis.

The Living Will is another document that shares similarities with the DPOA. While the DPOA allows an agent to make a variety of decisions, a Living Will specifically outlines an individual's wishes regarding end-of-life care and medical treatment preferences. This document can complement the DPOA by providing clear guidance to the agent about the principal's desires concerning life-sustaining treatments.

For those seeking to explore similar legal documents, it is also worthwhile to consider the Georgia PDF Forms, which provide a variety of resources and templates that can assist individuals in understanding and managing their power of attorney needs effectively.

The Revocation of Power of Attorney is also relevant. This document allows a principal to formally cancel a previously granted power of attorney. Similar to the DPOA, it requires clear communication of the principal's intentions. The revocation ensures that any prior authority granted to an agent is no longer valid, providing a mechanism for individuals to regain control over their affairs.

The Guardianship Petition shares some similarities as well. This legal document is used to request the appointment of a guardian for an individual who is unable to make decisions due to incapacity. While the DPOA allows a principal to choose their agent, a guardianship is typically established through a court process, which can be more time-consuming and may not reflect the individual’s preferences as directly as a DPOA.

The Conservatorship is another related document. It involves a court-appointed individual who manages the financial affairs of someone deemed incapacitated. Like a DPOA, a conservatorship provides a way to manage another person’s financial matters, but it requires judicial oversight, which can be more restrictive and less flexible than the arrangements made through a DPOA.

A Trust Agreement is also similar in that it allows for the management of assets. A trust can designate a trustee to handle the assets for the benefit of the trust's beneficiaries. While a DPOA allows an agent to make decisions on behalf of the principal, a trust can provide a structured way to manage and distribute assets according to the principal’s wishes, often without the need for probate.

The Medical Directive is another document that relates closely to the DPOA. This form allows individuals to specify their preferences regarding medical treatment in the event of incapacitation. While the DPOA grants an agent the authority to make decisions, a Medical Directive provides specific instructions that the agent must follow, ensuring that the principal's healthcare preferences are honored.

The Financial Power of Attorney is closely aligned with the DPOA as well. This document specifically grants an agent the authority to manage financial matters, such as banking, investments, and property transactions. While the DPOA can cover a broader range of decisions, a Financial Power of Attorney focuses solely on financial affairs, making it a useful tool for individuals who want to ensure their financial interests are protected.

Lastly, the Durable Power of Attorney for Finances is a specific variation of the DPOA that emphasizes financial matters. This document remains effective even if the principal becomes incapacitated, similar to the general DPOA. It allows the agent to manage the principal’s financial responsibilities, ensuring that bills are paid and assets are managed according to the principal's wishes, even during periods of incapacity.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | An Arizona Durable Power of Attorney allows an individual to appoint someone else to make financial or legal decisions on their behalf, even if they become incapacitated. |

| Governing Law | The Arizona Durable Power of Attorney is governed by Arizona Revised Statutes, Title 14, Chapter 5. |

| Durability | This form remains effective even if the principal becomes incapacitated, which distinguishes it from a regular power of attorney. |

| Agent Authority | The appointed agent can manage a wide range of financial matters, including banking, real estate, and business transactions. |

| Execution Requirements | To be valid, the form must be signed by the principal and acknowledged before a notary public or signed by two witnesses. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent to do so. |

Additional State-specific Durable Power of Attorney Forms

California Durable Power of Attorney Form - Choosing someone you trust is key, as they will be making significant decisions on your behalf.

Understanding the importance of a well-structured Lease Agreement form can make a significant difference in tenancy arrangements. This vital document serves as a protection mechanism for both landlords and tenants. For more information on creating a solid lease, consider using our thorough Lease Agreement template to ensure all critical aspects are covered.

Mo Poa - Designate a trusted individual to handle your financial and legal matters.

Tn Power of Attorney Form - A Durable Power of Attorney does not replace a will or other estate planning documents.

Power of Attorney Texas Form - The form cannot be used after your death, making its timing of execution important.

Sample - Arizona Durable Power of Attorney Form

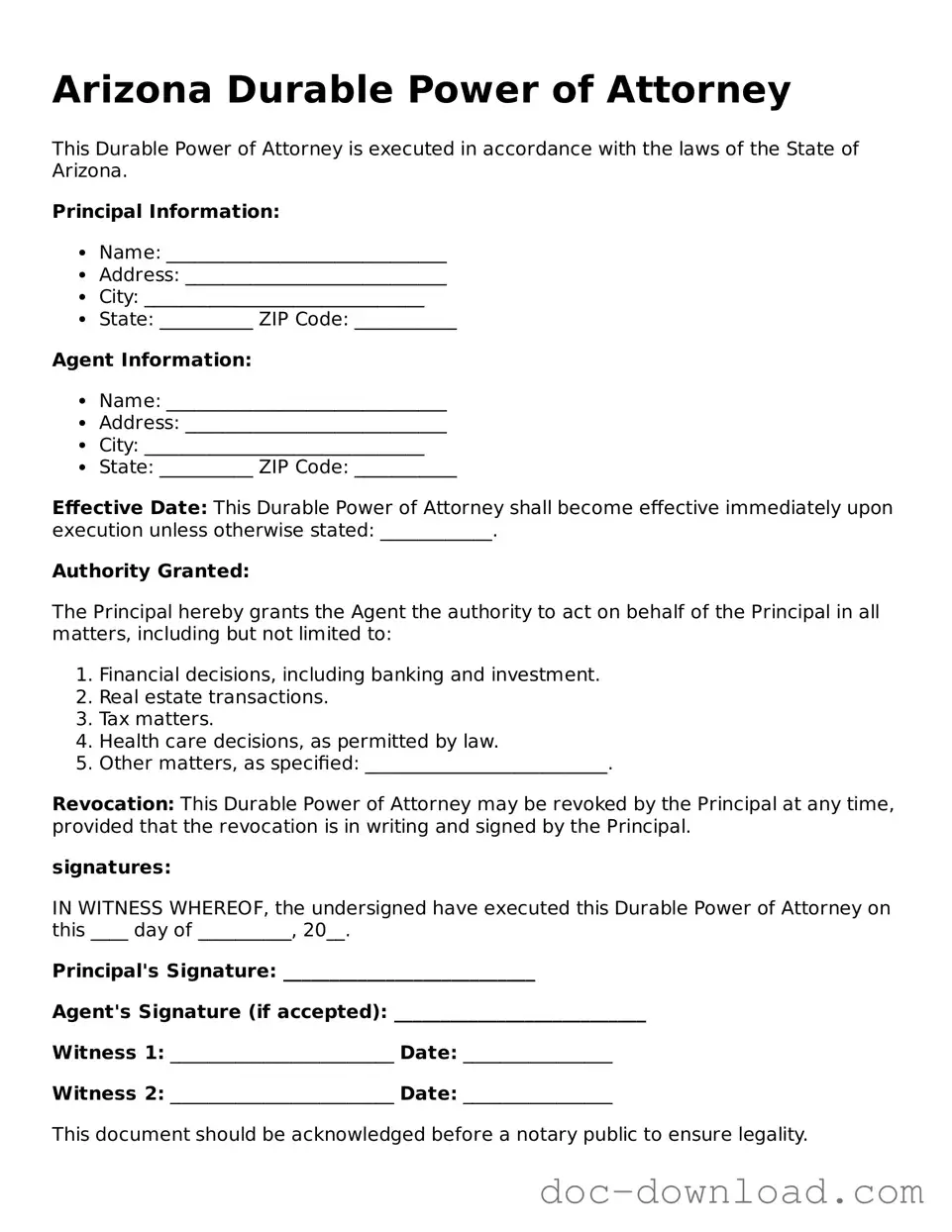

Arizona Durable Power of Attorney

This Durable Power of Attorney is executed in accordance with the laws of the State of Arizona.

Principal Information:

- Name: ______________________________

- Address: ____________________________

- City: ______________________________

- State: __________ ZIP Code: ___________

Agent Information:

- Name: ______________________________

- Address: ____________________________

- City: ______________________________

- State: __________ ZIP Code: ___________

Effective Date: This Durable Power of Attorney shall become effective immediately upon execution unless otherwise stated: ____________.

Authority Granted:

The Principal hereby grants the Agent the authority to act on behalf of the Principal in all matters, including but not limited to:

- Financial decisions, including banking and investment.

- Real estate transactions.

- Tax matters.

- Health care decisions, as permitted by law.

- Other matters, as specified: __________________________.

Revocation: This Durable Power of Attorney may be revoked by the Principal at any time, provided that the revocation is in writing and signed by the Principal.

signatures:

IN WITNESS WHEREOF, the undersigned have executed this Durable Power of Attorney on this ____ day of __________, 20__.

Principal's Signature: ___________________________

Agent's Signature (if accepted): ___________________________

Witness 1: ________________________ Date: ________________

Witness 2: ________________________ Date: ________________

This document should be acknowledged before a notary public to ensure legality.