Blank Deed in Lieu of Foreclosure Document for Arizona

In Arizona, the Deed in Lieu of Foreclosure serves as a significant alternative for homeowners facing financial distress and the potential loss of their property. This legal instrument allows a homeowner to voluntarily transfer the title of their property to the lender in exchange for the cancellation of the mortgage debt. By opting for this process, homeowners can avoid the lengthy and often costly foreclosure proceedings. The form outlines essential details, such as the names of the parties involved, a description of the property, and the terms under which the deed is executed. Additionally, it may include provisions regarding the release of the borrower from further liability for the mortgage debt, which can provide a fresh start for individuals burdened by financial challenges. Understanding the implications and requirements of the Deed in Lieu of Foreclosure is crucial for homeowners considering this option, as it can have lasting effects on their credit and future homeownership opportunities.

Similar forms

The Arizona Deed in Lieu of Foreclosure form shares similarities with a mortgage release document. Both serve to relieve a borrower from the obligation of repaying a mortgage. In a mortgage release, the lender formally cancels the mortgage, allowing the borrower to regain full ownership of the property without the burden of debt. This can be beneficial for homeowners looking to avoid foreclosure while still maintaining some control over their property situation.

Another related document is the short sale agreement. In a short sale, a homeowner sells their property for less than the amount owed on the mortgage, with the lender's approval. Like a deed in lieu, a short sale helps homeowners avoid foreclosure. However, in a short sale, the homeowner actively participates in selling the home, while a deed in lieu involves transferring ownership directly to the lender.

The loan modification agreement is also similar. This document outlines changes to the terms of an existing mortgage, typically to make payments more manageable for the borrower. While a deed in lieu results in the transfer of property, a loan modification keeps the homeowner in their home, albeit with new terms that may provide relief from financial strain.

Then there’s the foreclosure notice. This document is issued by the lender to inform the borrower of the impending foreclosure process. While the deed in lieu is a proactive approach to avoid foreclosure, the foreclosure notice represents the beginning of that process, highlighting the urgency for homeowners to explore alternatives like a deed in lieu.

The quitclaim deed also bears resemblance. This document allows a property owner to transfer their interest in the property to another party without any warranties. In a deed in lieu, the homeowner relinquishes their interest to the lender, similar to a quitclaim deed, but with the intention of resolving a mortgage default rather than merely transferring ownership.

Another similar document is the forbearance agreement. This is an arrangement between a lender and borrower that temporarily pauses or reduces mortgage payments. While a deed in lieu resolves the debt by transferring ownership, a forbearance agreement provides temporary relief, allowing the homeowner to keep their property while they work through financial difficulties.

The assumption of mortgage agreement is also relevant. In this scenario, a new buyer takes over the existing mortgage from the seller. This is similar to a deed in lieu in that it involves the transfer of property and debt obligations, but it requires a willing buyer to step into the borrower’s shoes rather than simply relinquishing the property to the lender.

Another document to consider is the bankruptcy filing. When a homeowner files for bankruptcy, it can halt foreclosure proceedings and provide a way to reorganize debts. While a deed in lieu is a voluntary transfer of property to avoid foreclosure, bankruptcy is a legal process that can also lead to the discharge of debts, but with more complex implications.

In situations where owners need to handle property transactions, various documents like Quitclaim Deeds can be beneficial. A Florida Quitclaim Deed is particularly useful for transferring property rights without the guarantee of title, often seen in family property transfers or resolving title disputes. To learn more about how to use this specific type of deed, you can visit https://quitclaimdeedtemplate.com/florida-quitclaim-deed-template.

Lastly, the release of lien document is relevant. This document is used to formally remove a lien from a property once the debt has been satisfied. A deed in lieu effectively serves a similar purpose by transferring ownership and eliminating the mortgage lien, providing the borrower with a fresh start without the burden of the debt.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a homeowner voluntarily transfers the title of their property to the lender to avoid foreclosure proceedings. |

| Governing Laws | The deed in lieu of foreclosure in Arizona is governed by Arizona Revised Statutes (ARS) § 33-811 and § 33-812. |

| Eligibility | Homeowners must be in default on their mortgage and unable to make payments to qualify for this option. |

| Benefits | This process can help homeowners avoid the lengthy and stressful foreclosure process, potentially preserving their credit score. |

| Considerations | Before proceeding, homeowners should consider the tax implications and ensure they understand the terms of the agreement with the lender. |

Additional State-specific Deed in Lieu of Foreclosure Forms

Deed in Lieu of Mortgage - Banks and lenders often prefer this route to recover losses without the need for foreclosure.

Creating a Last Will and Testament is an essential step to ensure that your wishes regarding asset distribution are honored after your passing; for residents of Colorado, utilizing resources like Colorado PDF Forms can simplify the process of obtaining and filling out the necessary documents.

California Pre-foreclosure Property Transfer - Helps borrowers settle mortgage obligations by surrendering the property voluntarily.

Sample - Arizona Deed in Lieu of Foreclosure Form

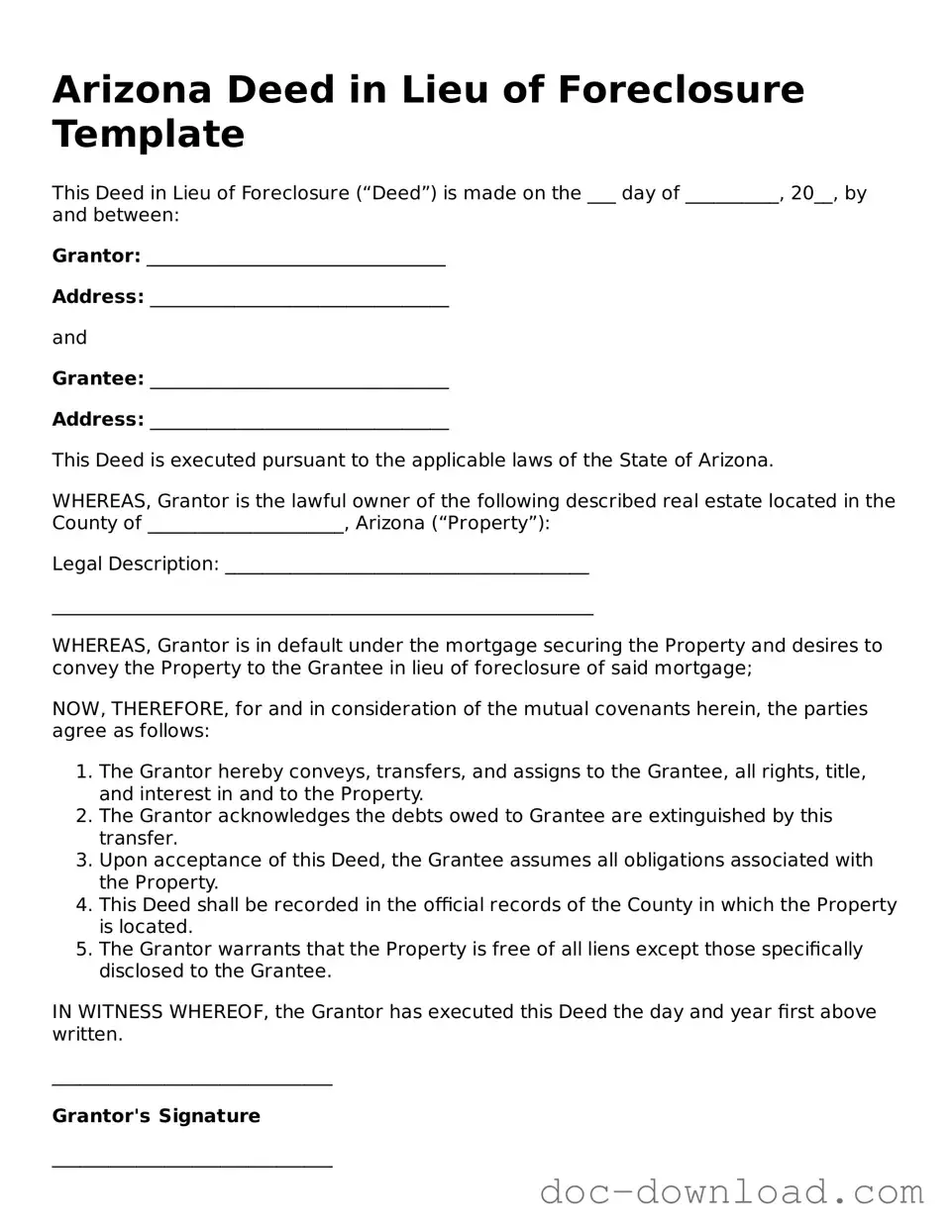

Arizona Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure (“Deed”) is made on the ___ day of __________, 20__, by and between:

Grantor: ________________________________

Address: ________________________________

and

Grantee: ________________________________

Address: ________________________________

This Deed is executed pursuant to the applicable laws of the State of Arizona.

WHEREAS, Grantor is the lawful owner of the following described real estate located in the County of _____________________, Arizona (“Property”):

Legal Description: _______________________________________

__________________________________________________________

WHEREAS, Grantor is in default under the mortgage securing the Property and desires to convey the Property to the Grantee in lieu of foreclosure of said mortgage;

NOW, THEREFORE, for and in consideration of the mutual covenants herein, the parties agree as follows:

- The Grantor hereby conveys, transfers, and assigns to the Grantee, all rights, title, and interest in and to the Property.

- The Grantor acknowledges the debts owed to Grantee are extinguished by this transfer.

- Upon acceptance of this Deed, the Grantee assumes all obligations associated with the Property.

- This Deed shall be recorded in the official records of the County in which the Property is located.

- The Grantor warrants that the Property is free of all liens except those specifically disclosed to the Grantee.

IN WITNESS WHEREOF, the Grantor has executed this Deed the day and year first above written.

______________________________

Grantor's Signature

______________________________

Grantee's Signature

STATE OF ARIZONA

COUNTY OF _____________________

This instrument was acknowledged before me on the ___ day of __________, 20__, by ________________________________.

______________________________

Notary Public

My Commission Expires: ______________