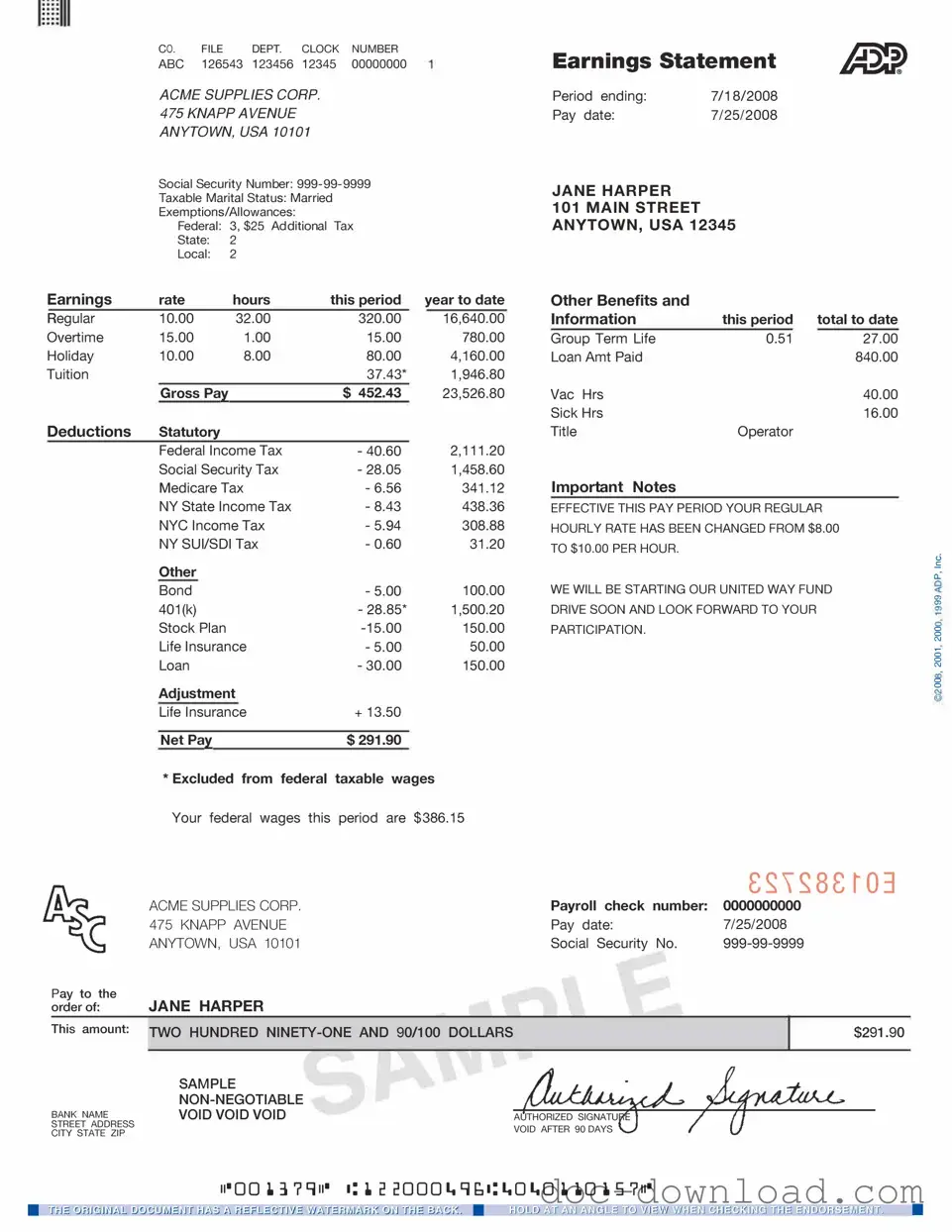

Fill Out Your Adp Pay Stub Template

The ADP Pay Stub form serves as a crucial document for employees, providing a detailed breakdown of their earnings and deductions for each pay period. This form typically includes essential information such as the employee's gross pay, net pay, and various deductions like taxes, retirement contributions, and health insurance premiums. Understanding this form is vital for employees to track their income accurately and ensure that the deductions align with their financial expectations. Additionally, the pay stub may feature year-to-date totals, which help employees assess their overall earnings and tax obligations throughout the year. By reviewing this information regularly, employees can make informed decisions regarding their finances and plan for future expenses. The clarity and transparency offered by the ADP Pay Stub form empower individuals to take charge of their financial well-being.

Similar forms

The W-2 form is a crucial document for employees in the United States. It summarizes an employee's annual wages and the taxes withheld from their paycheck. Similar to the ADP Pay Stub, the W-2 provides a detailed breakdown of earnings, including bonuses and other forms of compensation. While the pay stub reflects earnings for a specific pay period, the W-2 aggregates this information over an entire year, making it essential for tax filing purposes.

When it comes to purchasing or selling a vehicle, having the right documentation is essential to avoid complications. In this regard, the Bill of Sale for Cars is a vital legal document that not only confirms the transaction but also protects both parties involved. It ensures that all necessary details surrounding the transfer of ownership are properly recorded, thus safeguarding the rights of buyers and sellers alike during the vehicle sale process.

The pay statement is another document akin to the ADP Pay Stub. It serves as a record of an employee's earnings for a specific pay period, detailing hours worked, hourly rates, and deductions. Like the ADP Pay Stub, the pay statement provides transparency regarding how gross pay is calculated and what deductions are taken out, ensuring employees can easily understand their compensation.

A paycheck is also similar to the ADP Pay Stub, as it represents the actual payment an employee receives for their work. While the paycheck may not provide as much detail about deductions and contributions, it typically includes the gross pay and net pay amounts. Employees can refer to their pay stubs to understand the components that lead to the final paycheck amount, making both documents interconnected in the payroll process.

The 1099 form is another relevant document, particularly for independent contractors and freelancers. It reports income received outside of traditional employment, similar to how the ADP Pay Stub reports income for employees. Both documents provide a summary of earnings, but the 1099 focuses on non-wage income, highlighting the differences in tax implications for employees versus contractors.

The direct deposit receipt serves a similar purpose to the ADP Pay Stub by confirming that an employee's wages have been deposited into their bank account. This receipt may not provide as much detail about deductions or hours worked, but it does confirm the net amount deposited. Employees can cross-reference this receipt with their pay stub for a complete understanding of their earnings.

Finally, the payroll register is a comprehensive document that summarizes the payroll data for all employees in a specific period. Similar to the ADP Pay Stub, it includes information on gross pay, deductions, and net pay. However, the payroll register is more extensive, often used by employers to track payroll expenses and ensure compliance with tax obligations. Employees may not see this document directly, but it underpins the accuracy of their individual pay stubs.

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The ADP Pay Stub form provides employees with a detailed breakdown of their earnings and deductions for a specific pay period. |

| Components | It typically includes information such as gross pay, net pay, taxes withheld, and any other deductions like health insurance or retirement contributions. |

| Frequency | Pay stubs are usually issued on a regular basis, such as bi-weekly or monthly, depending on the employer's payroll schedule. |

| State-Specific Requirements | Some states have specific laws regarding pay stubs. For example, California requires that pay stubs include the employee's name, the pay period, and the total hours worked. |

| Digital Access | ADP offers digital access to pay stubs through its online portal, allowing employees to view and download their pay information anytime. |

| Record Keeping | Employees are encouraged to keep their pay stubs for record-keeping purposes, as they can be useful for tax filing and verifying income. |

| Tax Information | The pay stub provides essential tax information, including federal and state tax withholdings, which helps employees understand their tax obligations. |

| Employer Responsibilities | Employers must ensure that pay stubs are accurate and comply with applicable state laws to avoid penalties and ensure transparency. |

Different PDF Templates

Corporate Stock Ledger Example - Provides a clear history of stock ownership changes over time.

CBP Form 6059B - Each traveler must fill out their own CBP 6059B if traveling as a group.

A California Lease Agreement form is a written contract between a landlord and tenant that outlines the terms of renting a property. This document serves as the foundation of the rental relationship, detailing responsibilities and rights for both parties. To ensure a smooth rental experience, fill out the form by clicking the button below, and for additional resources, visit All Templates PDF.

Roof Condition Certification Form - It serves as a guarantee of the contractor's work quality.

Sample - Adp Pay Stub Form

|

CO. |

FILE |

DEPT. |

CLOCK |

NUMBER |

|

|

ABC |

126543 123456 |

12345 |

00000000 |

|

|

|

ACME SUPPLIES CORP. |

|

|

|||

|

475 KNAPP AVENUE |

|

|

|

||

|

ANYTOWN, USA 10101 |

|

|

|||

|

Social Security Number: |

|

||||

|

Taxable Marital Status: Married |

|

|

|||

|

Exemptions/Allowances: |

|

|

|

||

|

Federal: 3, $25 Additional Tax |

|

||||

|

State: |

2 |

|

|

|

|

|

Local: |

2 |

|

|

|

|

Earnings |

rate |

|

hours |

this period |

year to date |

|

Regular |

10.00 |

|

32.00 |

|

320.00 |

16,640.00 |

Overtime |

15.00 |

|

1.00 |

|

15.00 |

780.00 |

Holiday |

10.00 |

|

8.00 |

|

80.00 |

4,160.00 |

Tuition |

|

|

|

|

37.43* |

1,946.80 |

|

Gross Pa� |

|

|

$ 452.43 |

23,526.80 |

|

Deductions |

Statutory |

|

|

|

2,111.20 |

|

|

Federal Income Tax |

|

- 40.60 |

|||

|

Social Security Tax |

|

- 28.05 |

1,458.60 |

||

|

Medicare Tax |

|

- 6.56 |

341.12 |

||

|

NY State Income Tax |

|

- 8.43 |

438.36 |

||

|

NYC Income Tax |

|

- 5.94 |

308.88 |

||

|

NY SUI/SDI Tax |

|

- 0.60 |

31.20 |

||

|

Other |

|

|

|

|

|

|

Bond |

|

|

|

- 5.00 |

100.00 |

|

401(k) |

|

|

|

- 28.85* |

1,500.20 |

|

Stock Plan |

|

|

150.00 |

||

|

Life Insurance |

|

- 5.00 |

50.00 |

||

|

Loan |

|

|

|

- 30.00 |

150.00 |

|

Adjustment |

|

|

|

||

|

Life Insurance |

|

+ 13.50 |

|

||

|

Net Pa� |

|

|

$291.90 |

|

|

*Excluded from federal taxable wages Your federal wages this period are $386.15

ACME SUPPLIES CORP. 475 KNAPP AVENUE ANYTOWN, USA 10101

Pay to the

order of: JANE HARPER

This amount: TWO HUNDRED

SAMPLE

BANK NAMEVOID VOID VOID

STREET ADDRESS

CITY STATE ZIP

Earnings Statement

Period ending: |

7/18/2008 |

Pay date: |

7/25/2008 |

JANE HARPER

101MAIN STREET

ANYTOWN, USA 12345

Other Benefits and

Information |

this period |

total to date |

|

|

Group Term Life |

0.51 |

27.00 |

|

|

Loan Amt Paid |

|

840.00 |

|

|

Vac Hrs |

|

40.00 |

|

|

Sick Hrs |

|

16.00 |

|

|

Title |

Operator |

|

|

|

Important Notes |

|

|

|

|

EFFECTIVE THIS PAY PERIOD YOUR REGULAR |

|

|||

HOURLY RATE HAS BEEN CHANGED FROM $8.00 |

|

|||

TO $10.00 PER HOUR. |

|

|

0 |

|

|

|

|

||

|

|

|

.!: |

|

WE WILL BE STARTING OUR UNITED WAY FUND |

0: |

|||

"' |

||||

DRIVE SOON AND LOOK FORWARD TO YOUR |

|

|||

|

|

|||

PARTICIPATION. |

|

|

0 |

|

|

|

|

0 |

|

C\J

0

0

C\J

0

0

|

£�,�8£�03 |

Payroll check number: |

0000000000 |

Pay date: |

7/25/2008 |

Social Security No. |

$291.90