Fill Out Your Acord 50 WM Template

The Acord 50 WM form plays a crucial role in the world of insurance, serving as a vital tool for agents and brokers alike. This form is primarily utilized for reporting workers' compensation insurance information, ensuring that all necessary details are accurately conveyed to the relevant parties. Key aspects of the Acord 50 WM include its structured format, which allows for the easy collection of essential data such as policy numbers, coverage limits, and the names of the insured. Additionally, the form aids in streamlining the communication process between insurers and clients, fostering transparency and efficiency. By adhering to the guidelines set forth in the Acord 50 WM, stakeholders can minimize errors and misunderstandings, ultimately leading to smoother transactions and better service delivery. Understanding the intricacies of this form is essential for anyone involved in the workers' compensation insurance landscape.

Similar forms

The Acord 50 WM form is often compared to the Acord 25 form, which is a standard certificate of insurance. Both documents serve to provide proof of insurance coverage to third parties. The Acord 25 details the types of coverage and limits in place, similar to how the Acord 50 WM outlines specific workers' compensation information. Each form is designed to communicate essential insurance details clearly and concisely.

Another similar document is the Acord 27 form, which is used for property insurance. Like the Acord 50 WM, the Acord 27 provides a snapshot of coverage details. While the Acord 50 WM focuses on workers' compensation, the Acord 27 emphasizes property coverage. Both forms aim to provide necessary information to stakeholders, ensuring that everyone understands the coverage in place.

The Acord 130 form is also comparable, as it serves as a commercial insurance application. It gathers information about various types of coverage, including liability and property. The Acord 50 WM, however, is more specialized, concentrating solely on workers' compensation. Both forms require detailed information, but their focus areas differ, making them useful in their respective contexts.

Similarly, the Acord 140 form functions as a commercial auto insurance application. This form, like the Acord 50 WM, collects vital data to assess risk and coverage needs. While the Acord 50 WM is dedicated to workers' compensation, the Acord 140 zeroes in on auto-related coverage. Each form plays a crucial role in the insurance process, ensuring that applicants provide the necessary information for underwriting.

For those looking to understand the intricacies of company policies, a valuable resource is the thorough Employee Handbook guide. This form is essential for ensuring clarity on workplace expectations and regulations, serving as a valuable reference for both employees and management.

The Acord 51 form is another related document, which is a certificate of liability insurance. It provides evidence of general liability coverage, much like how the Acord 50 WM provides proof of workers' compensation insurance. Both documents are essential for businesses to demonstrate compliance with insurance requirements, fostering trust with clients and partners.

In the realm of health insurance, the Acord 16 form is similar in that it serves as a health insurance application. While the Acord 50 WM focuses on workers' compensation, the Acord 16 gathers information for health coverage. Both documents are designed to collect relevant data, ensuring that applicants receive the appropriate coverage based on their needs.

The Acord 2 form is another form that shares similarities with the Acord 50 WM. This document acts as a general application for insurance and collects information across multiple coverage types. While the Acord 50 WM is more specialized, both forms require detailed responses from applicants to accurately assess risk and determine coverage options.

The Acord 4 form is also relevant as it serves as a commercial lines application. This form gathers data for various types of commercial insurance, including liability and property. The Acord 50 WM, on the other hand, is focused solely on workers' compensation. Both forms aim to ensure that applicants provide comprehensive information to facilitate the underwriting process.

Lastly, the Acord 80 form is comparable as it is a personal auto insurance application. While it focuses on personal auto coverage, much like the Acord 50 WM, it emphasizes the importance of providing detailed information. Both documents are crucial in the insurance landscape, helping applicants secure the necessary coverage tailored to their specific needs.

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Acord 50 WM form is primarily used for workers' compensation insurance applications. |

| Standardization | This form is part of the Acord family of standardized insurance forms, promoting consistency in applications. |

| Filing Requirements | Insurers often require the Acord 50 WM form to be completed for processing workers' compensation coverage. |

| Information Collected | The form collects essential information about the business, including its name, address, and type of operations. |

| State-Specific Variations | Some states may have specific requirements or variations of the Acord 50 WM form, depending on local regulations. |

| Governing Laws | The form is governed by state-specific workers' compensation laws, which can vary significantly across jurisdictions. |

| Submission Process | The completed form is typically submitted to the insurance company or broker for review and approval. |

| Accuracy | It is crucial for the information provided on the form to be accurate to avoid potential issues with coverage. |

| Renewal Use | The Acord 50 WM form may also be used during the renewal process for existing workers' compensation policies. |

| Industry Adoption | Many insurance companies across the United States accept the Acord 50 WM form, making it widely recognized. |

Different PDF Templates

I134 - The I-134 aids consular officials in their assessment of a visa applicant's needs.

When dealing with property transfers, it's essential to understand the specifics of a Colorado Quitclaim Deed, as it serves as a legal document for conveying ownership rights without the assurance of a clear title, often utilized among family members or to resolve title disputes; for those looking to obtain the necessary forms, you can find them at Colorado PDF Forms.

Da - Quantifiable data on the form assists in comparing reported inventories against physical counts.

Sample - Acord 50 WM Form

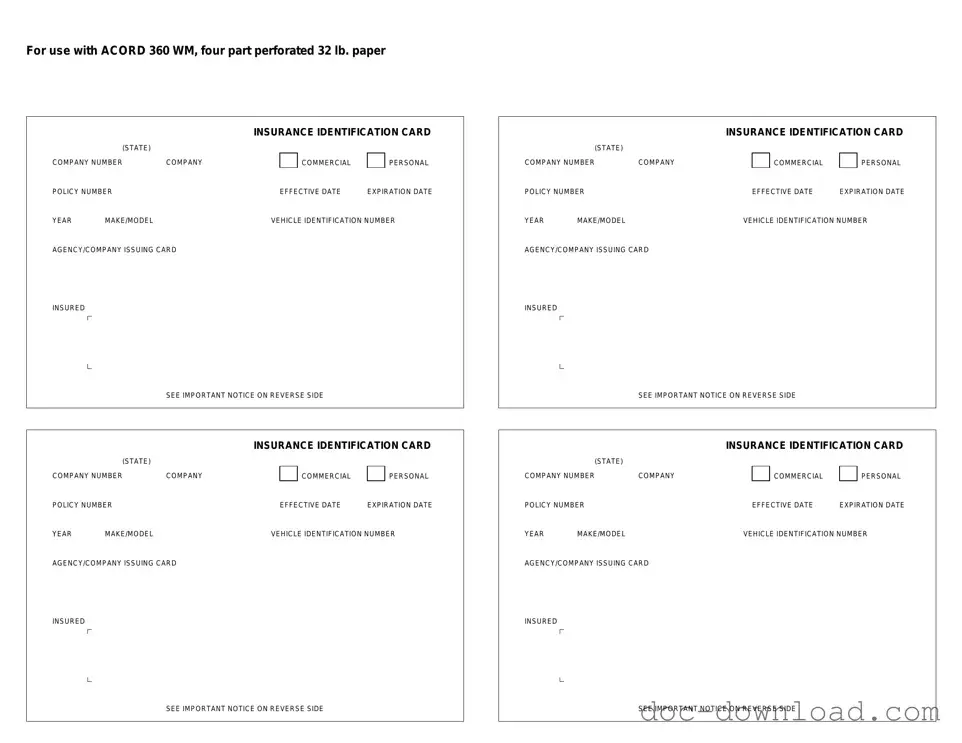

For use with ACORD 360 WM, four part perforated 32 lb. paper

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |